Hey,

I don’t know for you, but I do love this feeling of things starting over, of new projects, and somewhat of optimism in the air. I know, COVID is not finished, a second wave threatens and many bad things could still happen, but I feel energized. After months of lockdown (and summer vacations upon that), workers inside companies, large and small (and especially entrepreneurs) have had time to think about innovation. This is now transforming into projects that we can’t wait to get our hands on! We have seen amazing startups emerging in the last couple of months that will help FoodTech grows faster and further.

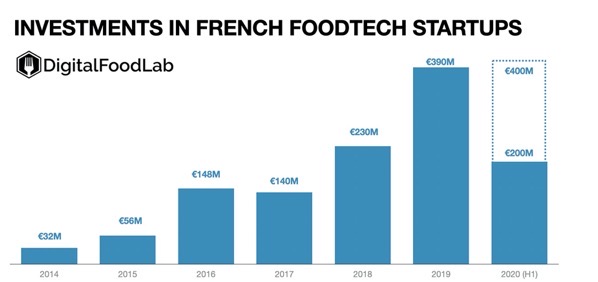

And we are really pleased to see that this is also true in France. We have just released our third report on the French FoodTech ecosystem. With more than 1200% growth in the last six years, France has moved from being a dot on the world’s Foodtech to be a significant hub. This is particularly impressive if compared to the “mere 400%” or 320% of European and Global FoodTech investments.

As shown in the above graph (the report contains much more data and notably includes a list of all the active startups in France), COVID was not enough to stop FoodTech growth. In the first half of the year, French FoodTech startups raised more than €200M and are on the path for beating last year’s record.

However, the situation is not 100% perfect, notably if we look at the future. French FoodTech ecosystem had 2 main issues concerting its financing: tiny pre-seed deals and larger series B+ deals (of €10M and more). The latter point has been solved with more and more significant deals (such as Ynsect raising €110M in 2019 and Swile €70M in 2020). Yet, the former issue remains. The number of small deals (pre-seed and below €500k seed deals) is too low to create the sustainable growth the ecosystem needs in the long term. €20M+ deals account for almost 60% of all the investments and this share is rising. It’s far too soon for France’s FoodTech to become mature.

Another issue is the heavy concentration around Paris. The capital and its region account on average for 61% of the deals and 75% of the investments. These high figures (Paris’ region is home to 18% of France’s population and 30% of its GDP) are only rising. Many local accelerators and publicly backed VC funds have emerged recently but they don’t seem to move the trend.

In a word, France’s FoodTech (and in extension France’s tech ecosystem) needs more entrepreneurs from more diverse backgrounds to try entrepreneurship. It also needs much more business angels to finance them (5 times less of them in France than in the UK). At a larger scale, there is an opportunity for one or more dedicated early-stage funds to use a “spread and pray” strategy, multiplying small bets in the French Foodtech ecosystem, notably on projects inspired by the strongest trends (protein alternatives, transparency & traceability, urban farming, meal automation, etc.).

Should you want to know more about our report pricing and contents, just go here. We’ll also have a webinar on the future of French FoodTech on the 24th (in French – free registration here).

Have a great week!

TOP INSIGHTS FROM DIGITALFOODLAB

#1 – Solar Foods raises €18.5M to transform air into protein

Solar Foods, a Finnish startup raised a €18.5M series A led by Fazer Group (with €15M) and Agronomics (€3M). Lifeline Ventures and CPT Capital also participated in this round. The startup, which had already raised more than €2M in the last couple of years, works on an innovative process which extracts creates a protein (Solein in the case of Solar Foods) out of CO2 (i.e. the carbon in the atmosphere which is a cause of climate change) with the use of water and electricity. Solar Foods, with Deep Branch Technology and Air Protein is a part of a handful of startups working on this potentially revolutionary technology.

#2 – Startups raises money all over Europe to reinvent online groceries

Farmy, a Swiss startup raises €9.2M for its online supermarket. This event has to be considered among a wave of deals. Among the most interesting deals in the last months alone, we have Picnic’s €250M in late 2019, Mathem (Sweden) €47.5M, La Belle vie €11.6M, Crisp (Netherlands) $12M, BuyMie (Ireland) €5.8M. These are only a handful of many more deals happening all over the continent. This trend goes beyond Europe (and actually is more developed elsewhere). One example is the recent acquisition of restaurant delivery unicorn Delivery Hero into this market with the acquisition of Instashop.

#3 – Delivery Hero keeps growing through acquisitions as it enters the DAX

In the Aftermath of the Wirecard’s scandal, Delivery Hero will enter the DAX (the German leading stock market index made of 30 companies only). Delivery Hero announced the acquisition of InstaShop, an Instacart-like company active in the United Arab Emirates (UAE), Egypt, Lebanon, Bahrain, and Greece for $360M. Founded by Greek entrepreneurs, and with only $7M raised until now, InstaShop has grown fast and has now more than 500,000 users

YOU LIKE THIS CONTENT? SHARE IT WITH SOMEONE WHO MIGHT LEARN SOMETHING FROM IT!

We grow with your help. So, if you like this content and feel that it might help someone to understand how Ag, Food and Retail will be disrupted in the incoming years, share this newsletter or subscribe him or her here!

You still want more, here are some of our favorite reads of the last couple of weeks:

- Pinduoduo goal is to sell $145B of farm products in five years (more on Techcrunch)

- A deep dive inside Instacart’s use of metrics to drive its workers to be more productive (more here on the LA Times)

As you can see, FoodTech is indeed moving faster than ever in 2020. But you are not alone. DigitalFoodLab is here to help you :

- Stay at the top of your domain. We prove exclusive insights and information through talks and our FoodTech watch

- Prepare for the future. We help you make plans for long term trends and their implication on your business and to identify the right startup to work on your current issues.

- Innovate faster. We work with you to define the innovation strategy fitted to your business means and needs.

No matter if you are a startup or a food giant, we are here to work with you and change the world of food! (contact us).