In the past couple of weeks, with all the 2022 trends and predictions released (notably by DigitalFoodLab), I have had many interesting conversations about the future of food. Beyond the obvious hype sectors (alternative proteins notably), one theme was coming again and again: personalisation.

What do we mean by food personalisation?

Basically, we can identify three “levels” of personalisation (to use the analogy with autonomous cars):

- Level 0 – no personalisation: you eat what you want until health warnings such as a high level of cholesterol or pre-diabetes.

- Level 1 – assistance: getting to know the broad needs of any individual – what are his/her needs in terms of macronutrients (proteins, fats, carbs) and which foods are to be avoided. With this knowledge, services can assist the consumer in its daily choices.

- Level 2 – nutritional plan: getting to know*the specific needs in terms of micronutrients, the predisposition to certain illnesses and the specifics of digestion. This enables the creation of personalised nutritional plans and food supplements.

- Level 3 – personalised foods: making the previous data adaptable to the environment of the individual(daily activity and intakes) to create fully personalised foods such as meals.

- Level 4 – automation: as level 3 but without the need for intervention from the consumers to add their food intakes, levels of energy, daily activities, etc.

- Level 5: no human intervention is needed, your food is fully automated and personalised

Where are we?

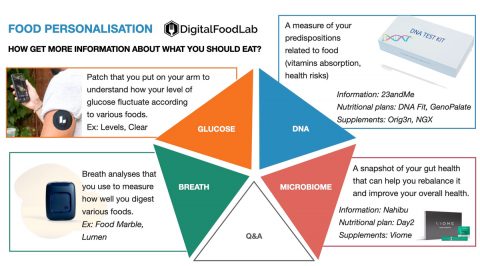

So, according to the previous levels indicated the goal is to reach at least the third level. However, **the industry (mostly startups) is mostly between levels 1 and 2**. While the space was limited to nutrigenomics (the science combining nutrition and genomics), it has increased with new “testing kits” using different data points. The mapping below show the various categories used to provide some level of assistance:

What we observe is that more and more companies are going beyond giving “general advice” (such as “eating fewer carbs” or “increase your consumption of vitamin C”) with nutritional plans and even subscription plans to food supplements. The British ecosystem is particularly well-positioned here with:

- Zoé, a startup that combines microbiome and glucose information to prove its users with deep insights and advice

- NGX, an early-stage startup that combines its users DNA and (sport and wellness) goals to create personalised ready-to-eat meals.

What’s next?

Food personalisation has been seen the future for at least the past 20 years. It may well remain a thing of “the future” for the next decade. However, we observe significant progress toward this goal with more tools helping consumers to understand and act on their metabolism.

A second step forward has been the dramatic reduction in the costs associated with the various tests mentioned. Genome sequencing, microbiome testing and glucose monitoring have become commodities and the value is now much more in the hands of the companies that create value out of the data.

We expect to see more and more services combining various sources of data (using these cheap tests and devices) to provide real value and actionable insights from consumers. Food companies will certainly focus on situations where the incentive to follow a strict diet and to track all your intakes is strong. Obvious candidates are sport (endurance, muscles gain, weight loss) and food-related (often) avoidable illnesses (such as Diabetes Type 2). These two markets alone represent a huge potential, both for new ventures and for CPG leaders. They will certainly experiment with the idea of personalisation in the near future.

Do you want to plan the future of your food or retail company in a world where food will become more personalised? We have already worked with world-leading food corporations to help them understand this space, identify how it may threaten their current business model and leverage the huge opportunities it represents. contact us here!