So, how are things going for FoodTech? Looking at the press and even at this newsletter, we could think we are near the end of the story. Each week, we read news about startups shutting down, filing for bankruptcy or being acquired for pennies. However, that’s not the whole story; quite the opposite. While things are complicated for many companies, deals are still being made. Today, I am glad to share with you DigitalFoodLab’s latest update on investments and top deals for the third quarter of 2023.

Global FoodTech investments are stabilising and showing signs of a potential bounce back.

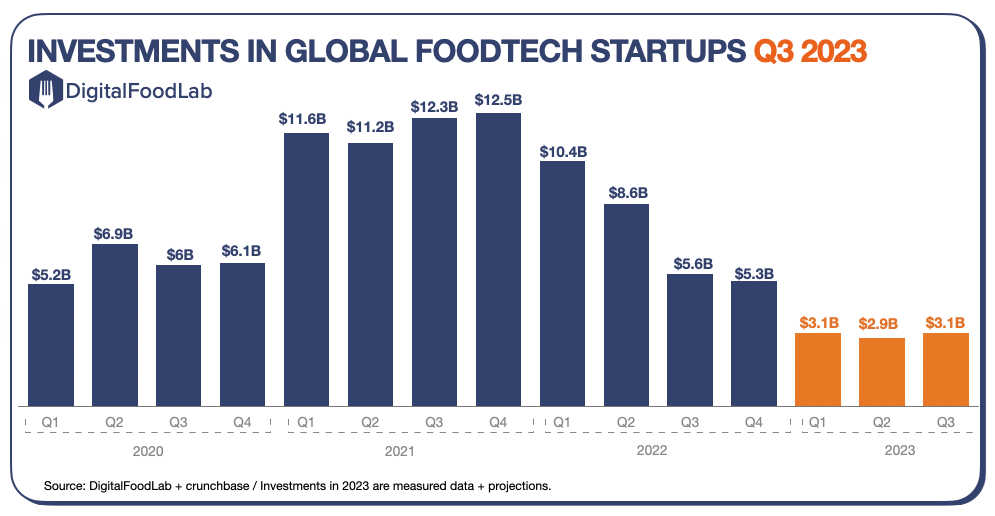

As you can see below, investments are pretty stable for the first three quarters of this year. This is actually good news: investments tend to be lower in a “normal” Q3 as fewer deals happen and higher at the end of the year (2020, 2021, and 2022 have been all but normal years). Even if the fourth quarter is strong, we’ll have reached a level of investments equivalent to 2017, a decrease of 50% compared to 2022 and 70% compared to 2021 (without even mentioning inflation). These two figures help to understand what is happening.

However, we have to look beyond money. The number of deals and, more importantly, the destination of the investments in terms of geographies and categories give us reasons to be very optimistic.

The European moment

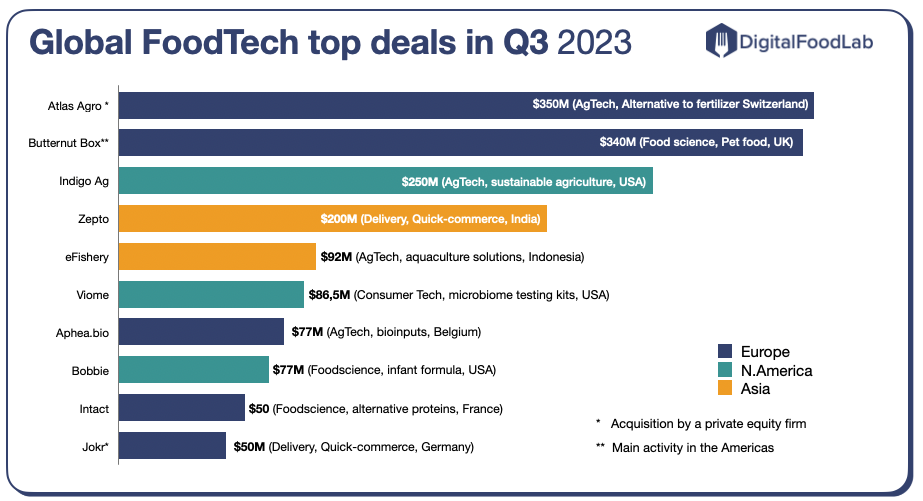

As you can see on the opposite chart, most of last quarter’s top deals came from European startups.

It is also noticeable that 2 of them are based in Europe while operating in North or South America. That’s also relatively new. We are used to the opposite.

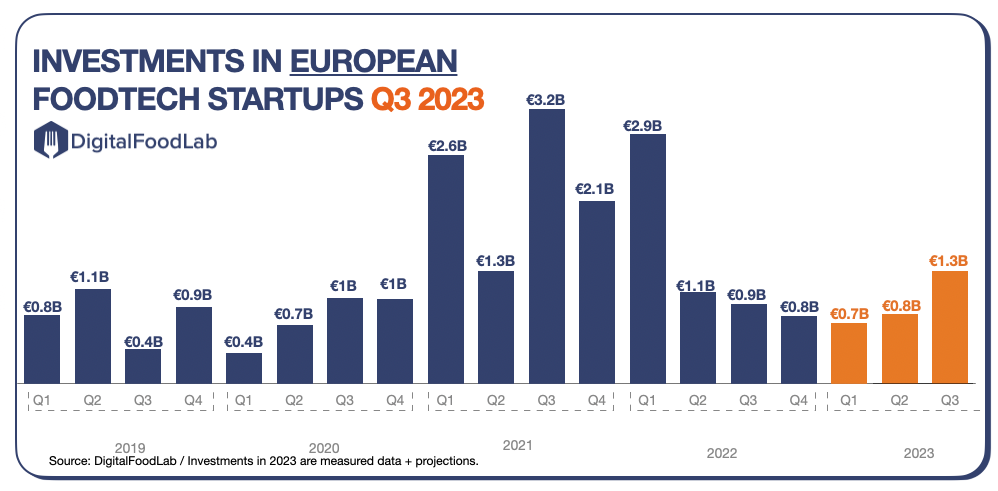

In terms of investments, European FoodTech is experiencing a much less severe decrease in funding. Compared to the figures mentioned above, investments are projected to decrease only by about 10% this year and to reach a level much higher than their 2020 level. And as you can see on the graph, a clear rebound is visible.

While Europe’s “share” of the global FoodTech funding was about 12%, it is now around 30%. It is a bigger share of a smaller cake, so we can’t be too proud. Yet, it means that something specific is happening in the old continent.

Sustainability first

What we observe in these graphs is the amount of all the investments made in FoodTech startups, from pitch to fork. If we go a step deeper, we have to look at which startups receive funding (with additional data that we will publish in our upcoming yearly public reports and our quarterly bespoke private updates for corporate and investor clients – if that interests you, contact us).

Basically, there is a global move away from delivery startups (with differences between the regions, as you can see in the top deals; in some areas, quick-commerce still makes sense). This is compensated by a new focus on a broad array of topics related to sustainability: long-term alternative proteins (notably ingredients), regenerative and less input-intensive agriculture, packaging, software promoting less food waste, etc… (all areas where Europe was already doing quite well). Long-term trends support this, so we expect it to be reinforced. In a word, if you don’t already have a focus on what’s happening in Europe, you should definitely start looking at it, or you may miss the next big thing.