INSIGHT:

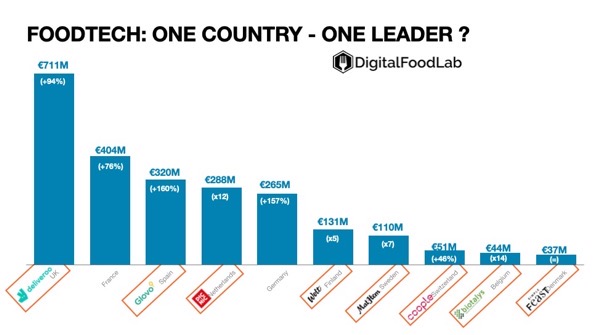

As shown in the above graph, investments in European FoodTech by countries in 2019 (with the growth from 2018), are divided into four groups, which remained stable for the last couple of years:

- The United Kingdom, leader for the last six years

- Co-leaders: France, Germany, The Netherlands, joined more recently by Spain (primarily due to Glovo)

- Small and dynamic ecosystems in the Nordic countries (united, the five countries would easily take the fourth place), Switzerland, Belgium and Italy (falling a bit behind).

- The remaining 30 countries lagging behind have local FoodTech ecosystems but little funding.

ONE COUNTRY – ONE STARTUP?

One of the key findings of this analysis is that for most countries, one startup accounted for more than 50% of all of 2019’s investments. Indeed:

- Deliveroo raised $575M (from Amazon), a large share of the UK’s 2019 FoodTech investments

- Glovo raised €300M (in two rounds), leading by large Spain’s FoodTech

- Picnic raised €250M in the Netherlands

- Wolt, the Finish restaurant delivery platform raised €115M of the €131M invested in Finish FoodTech startups

- Mathem, a Swedish e-grocery marketplace raised €86M

- Coople, the Swiss hospitality human resources app raised $32M

- Biotalys raised €35M of €44M Belgium FoodTech investments

- Simple Feast, a Danish innovative vegetarian meal kits startup raised €30M

Only France (even with the €110M deal in Ynsect) and Germany (with €90M in Infarm) didn’t have a 2019 “champion”.

Find out more in our FREE REPORT ON European FOODTECH INVESTMENTS