Key facts:

- Farmy, a Swiss startup raises €9.2M for its online supermarket

- This event has to be considered among a wave of deals

- Among the most interesting deals in the last months alone, we have Picnic’s €250M in late 2019, Mathem (Sweden) €47.5M, La Belle vie €11.5M, Crisp (Netherlands) $12M, BuyMie (Ireland) €5.5M. These are only a handful of many more deals happening all over the continent.

- This trends goes beyond Europe (and actually is more developed elsewhere). One example is the recent acquisition of restaurant delivery unicorn Delivery Hero into this market with the acquisition of Instashop.

Why it matters – DigitalFoodLab’s opinion:

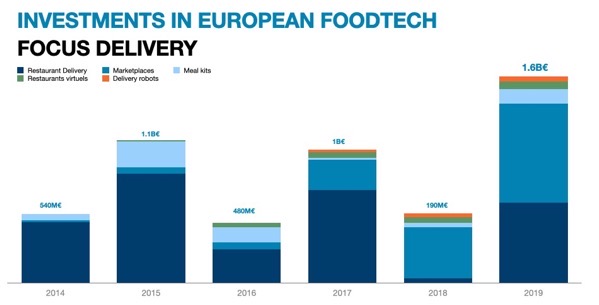

As shown in the graph above (accessible freely in our report on European FoodTech investments), Investments in Food Delivery in Europe have shifted from restaurant delivery (dark blue) to grocery delivery in a very significant way (lighter blue). The same trend, with a year ahead at least, can be visible when considering the same data at a global level.

However, when looking with more depth in this ecosystem, we can observe that it is not homogenous. It can be divided into three parts:

- The new retail (or the “big threat to current retailers”). These, as Kolonial (Norway) or Picnic (Netherlands), are rebuilding the whole infrastructure of a retailer with warehouses and delivery vehicles (often electric ones). They are 100% focused to online deliveries without any physical stores. They differentiate themselves from current retailers with better marketing strategies, same day or less than 24h deliveries and data-driven product assortments.

- The “uber for groceries” startups, led by Instacart (USA) and in Europe by Everly (formerly Supermercato24) and BuyMie. These startups are infrastructure-less and can deploy very fast. They task independent workers with their customers’ grocery lists to be made in supermarkets (and not in warehouses).

- Farm to home startups such as Cortilla (Italy) or Crisp (Netherlands). These, close to the first category, are less developed for now, and aim at providing customers with ingredients sourced locally.

This is a structuration which has been underway for a couple of years and we don’t expect one of these categories to be the winner over the others, at least immediately. Combined, all these startups may take significant market shares (and even more in terms of margin as they target urban high end customers) to incumbent retailers.