FoodTech is a trending topic. It is therefore not a surprise that some financial institutions have started to look at it by creating “products” around this trend. Here are two different examples that illustrate this interest and the limitations attached to it:

Invest in a portfolio of publicly-traded FoodTech companies

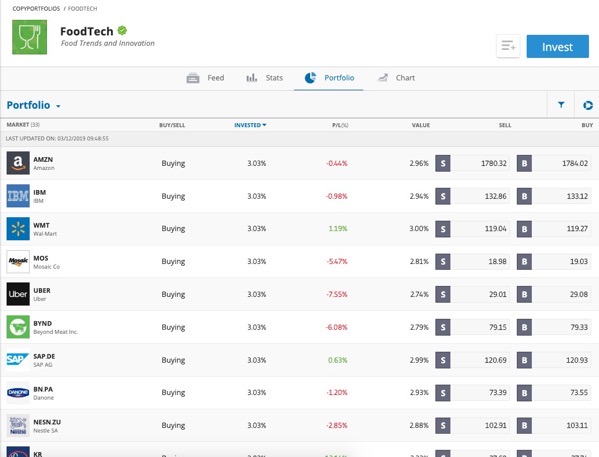

eToro is a social trading platform, basically enabling any customer to follow and copy the trades of other investors. It has a copy portfolio feature that lets you copy portfolios of assets (mostly company stocks) and replicate them. eToro launched recently (late October 2019) a FoodTech copyPortfolio.

As interesting as the idea should be, the selection is somewhat limited to a few startups and is mostly centred around tech giants (such as IBM, Amazon or SAP) and quite traditional agribusinesses (from Nestlé to Kroger). Indeed, as you can see in the portfolio, the issue is just that they are not many publicly traded FoodTech startups. At least you can find the following: Beyond Meat, Grubhub, Takeaway, Blue Apron, Ocado, Chewy and Delivery Hero

Vegan investor?

If one can wonder if a FoodTech portfolio is really meaningful, this kind of questions does not have stoped the launch of an exchange-traded-fund (basically an asset grouping some stocks, that is itself traded to replicate the variation of its holding and that you can buy and sell just like a common stock) named “US Vegan and Climate ETF” with name VEGN.

We can be even more surprised by its composition as its main holdings are tech giants, remote from the food business, such as Apple or Intel. This has led to some questioning, if not worse, press (which may be good to publicise a new financial product).

Why it matters?

In a word, FoodTech summarises both the promise of high growth companies and the solution to huge problems such as finding ways to provide proteins to a growing population. It is no wonder that people are keen to bet money on it, notably after the success of the IPO (initial public offering) of Beyond Meat. We can therefore expect to see more and more financial products around this trend (and more broadly around ethical and environmentally responsible food businesses) and in the near future, we may even see some of them being themselves more responsible.