I am glad to share our annual report on the European FoodTech ecosystem with you. This report has been made possible with the support of Nestlé.

You can download the full report here.

You can also register for our upcoming webinar (24th of April, 11:30 am CET) to discuss the report’s findings and the future of FoodTech investments globally and in Europe. In the meantime, let’s review some of the report’s main takeaways.

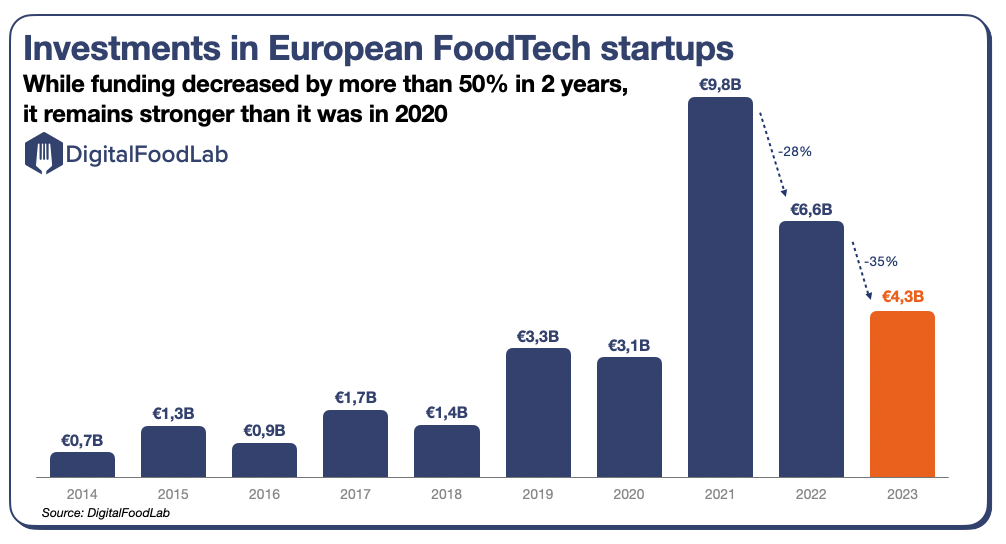

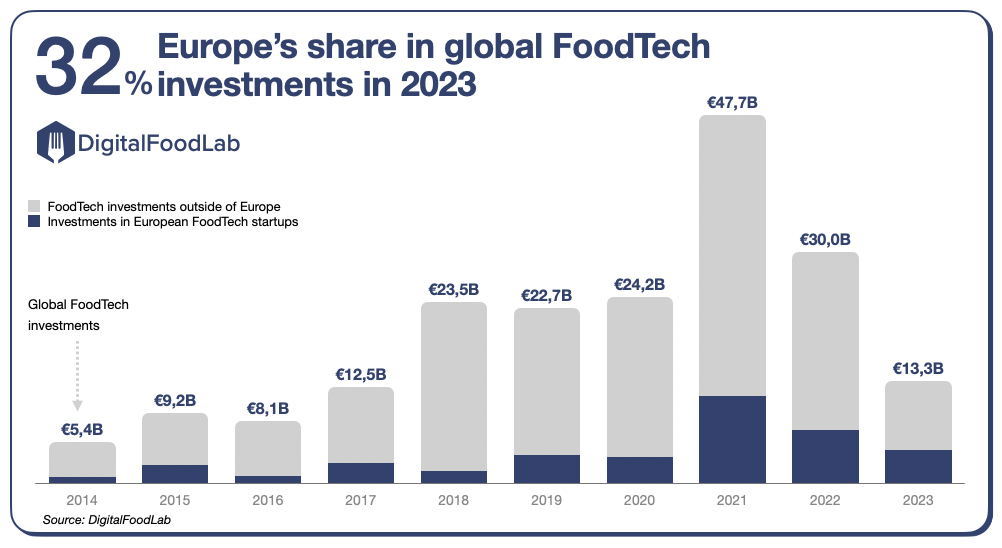

Key learning #1: Investments in European FoodTech startups are declining, but much less than in the rest of the world

European FoodTech startups raised €4.3B in 2023, a 35% decrease from 2022 and 56% from 2021, when investments peaked. However, investments remain much higher than they were in 2020.

If investments are declining in Europe, they are much less affected than in other regions. Global investments decreased by almost 56% between 2022 and 2023. As a consequence, Europe’s FoodTech weight increased. Now, Europe accounts for 32% of worldwide FoodTech investments, up from only 14% in 2020.

Key learning #2: the number of deals increased

While there is less money, we observed an increase in the number of deals, notably in early-stage. Investors are still very active in Europe and are betting on startups with an edge to surf long-term trends. In turn, the decrease in funding is due to a drastic reduction in large deals.

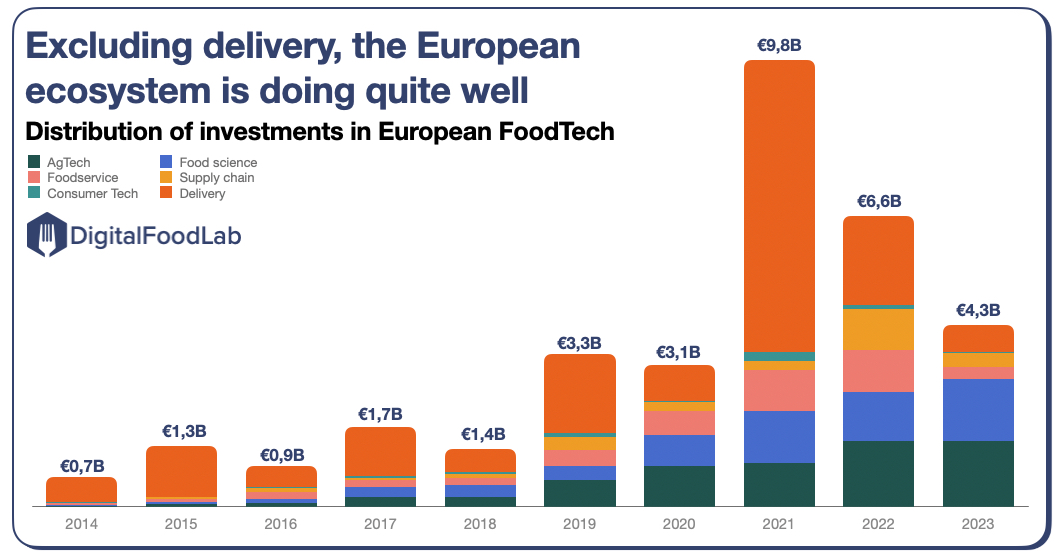

Key learning #3: investments increased upstream

It’s the seventh edition of DigitalFoodLab’s European FoodTech ecosystem report. Seven years is also often considered the usual lifespan of a successful startup from inception to exit. Quite accordingly, even in this complicated context, we observe the signs that the ecosystem is maturing. After a decade of being delivery-focused, the European FoodTech ecosystem is turning a page.

Indeed, delivery investments are declining (more than 90% since 2021). Excluding delivery, FoodTech investments in Europe were not far from being stable.

Investments in AgTech and in Food Science even increased:

- AgTech: while investments in indoor and urban farms almost vanished, we saw large deals in bioinputs (to reduce the amount of nitrogen put in the soil), carbon credit marketplaces, and farm management platforms.

- Food Science: alternatives proteins startups did well in Europe in 2023 contrary to what we may think (at least in terms of funding), as did CPG brands (food and beverage direct-to-consumer startups)

I would like to stress the importance of that point for the future role of FoodTech in Europe: in the rest of the world, investments declined severely in both categories. We identify at least three reasons to this good performance of the European FoodTech ecosystem:

- the role of public funding (with the combination of regional incentive, national grants, and EU-backed programs): they have accounted for a very significant part of the funding since 2022.

- the new role of international investors which are significantly venturing into European FoodTech startups since 2021 (directly or through new Europe-based funds).

- the appetite of European food companies (with many of the world’s largest being headquartered on the continent) which have shifted their focus to invest in innovation closer to their HQ and research centers.

Key learning #4: build your own report

While you can learn a lot on this report on the trends shaping the future of food, I am quite sure that many of you could benefit from bespoke insights. That’s why we build specific reports for clients and partners. Here are three examples:

- Publicly available and co-branded reports such as the one we recently released on Denmark’s FoodTech in partnership with Denmark’s Food & Bio Cluster.

- Private quarterly reports on specific regions (such as Italy or Latam) with an analysis on what it means for your company.

- Private bi-annual reports on a specific category (such as new brands or bioinputs) with an analysis and a scouting for inspiration, partnerships or acquisitions.

And now what’s next?

2024 will be a challenging year for FoodTech, in Europe and globally. Indeed, our first early insights about investments in the first quarter are showing a slight decline. However, we expect a bounce back early next year.

In the meantime, this represents an opportunity for leading food companies to partner, invest and acquire startups.