The first thing we did with DigitalFoodLab was to put a definition on FoodTech and try to categorise its different parts. As the ecosystem moves fast, we have had to adjust it over the years. Today, we are making our largest changes in the definition since 2016. At the core is still the idea that FoodTech is about innovation all along the food value chain, from agriculture to food products and the customer experience.

Basically what we have changed are:

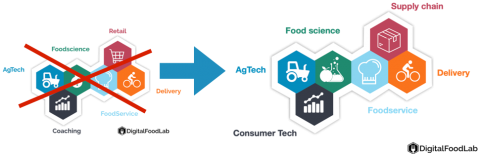

- two main categories: exit Retail and Coaching which have never grown and welcome to Supply chain and Consumer Tech. We wanted to stress the growing importance of innovation on the supply chain itself, notably on data but also on the packaging which is becoming increasingly important. Consumer Tech is also becoming more important with services (notably around personalisation) and a whole new space of food appliances launched by startups.

- many new sub-categories (here, you will be able to find the list and definitions of our 30 sub-categories) with notably quick-commerce (see below), alternative proteins and robotics (in each of the big categories).

This exercise is more than some sweeping of old definitions, it is a way to see where our thought was relevant and how the ecosystems have evolved. Entrepreneurs, investors (and consultants) should be reminded of the impermanence of fame for startup trends. One day at the top of the world, one day down, notably if you don’t have a sustainable business model.

Should you want a dedicated talk on FoodTech, its definition and trends (broadly or with a focus on your area) that is something we often do with our clients. Contact us here!

SINCE YOU ARE HERE: 4 DEALS AND 1 IPO THIS WEEK

Here are some of the most interesting deals (outside of grocery delivery) for the past week:

- Toast, a provider of software and hardware for ordering and payment for restaurants, made its public debut with a successful $15B IPO (the company raised $400M at a $5B valuation just before the pandemic). This success is both a signal of the strength of the payment and digital restaurant ecosystem and its rapid recovery. We can now expect a surge of funding in this space.

- In the same space, Sunday, the startup developing a pay-at-table solution for restaurants raised $100M. That comes after a $24M Series A earlier this year.

- Foodles, another (French) foodservice startup, raised €31M for its connected fridges / smart canteen, a topic that is becoming hotter and hotter as companies look to reduce their footprint and manage a more flexible workforce (and hence the high costs of a dedicated canteen).

- A new FoodTech unicorn! Grubmarket raises $120M. This startup has a really interesting story. Initially, it was a farm-to-home, focused on delivering fresh produce. It has grown beyond this market to help food suppliers to address their own consumers (restaurants, supermarkets).

- Formo, a German-based startup, raised €42M for its precision fermentation (see here for a recap on fermentation and other alternative proteins) technology to replace cheese.