INSIGHT:

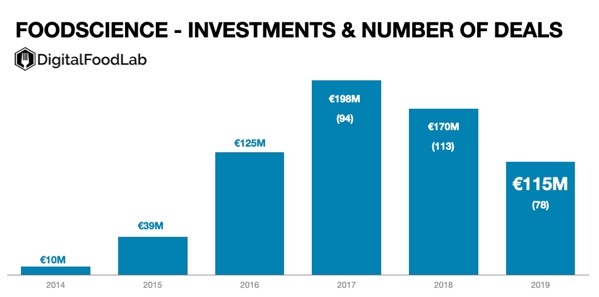

As investments in European FoodTech have risen sharply between 2018 and 2019 (and even more if we compare on a 5 year scale), this is absolutely not the case for foodscience. As one of the 6 categories of FoodTech, foodscience startups are developing new food products answering the need for more transparency, health and environmental concerns. Products range from market innovations to radical disruptions using revolutionary ingredients.

After the highly commented success of Beyond Meat’s IPO in May 2019 and the following competition with Impossible Foods to enter fast-food chains such as Starbucks and McDonald’s, we were expecting to see a “Beyond meat effect” on investments. That is to say, we were almost certain that investments in meat replacement (either plant-based or lab-grown) would have surged. It was undeniably the case in other continents, but apparently not in Europe.

Even in Direct to consumer (D2C), the most notable operations were the acquisition of Foodspring by Mars, the €17M deal in Strong Roots or the investment of Chanel in Sulapac, a Finish biodegradable packaging company.

On a more optimist note, a new generation of more realistic businesses (focused on building a profitable activity rather than rapid growth) is appearing in various parts of Europe.

WHY IT MATTERS?

It seems to be specifically hard to grow a foodscience unicorn in Europe. One of the reasons for the decrease in investments in this domain lies in the difficulties of entrepreneurs to cross borders to reach other European markets. Indeed, if a product (notably through retail) is successful in one country, its company has almost to start over for each new one it wants to enter.

Having a strong local foodscience ecosystem is more important than it appears. Indeed, the new food ecosystem is looking more and more like software with a concentration of the value creation.

Find out more in our FREE REPORT ON European FOODTECH INVESTMENTS