Most entrepreneurs want to create “billion-dollar companies” like this “unicorn” status is a synonym with fame and also implies that you are starting to disrupt your ecosystem. But, how many reach that goal in FoodTech?

We can find some answers in DigitalFoodLab’s updated mapping of the Unicorns in FoodTech in 2021. In Europe, for example, we have 3,500 active startups in our database but only 13 unicorns. In other words, a founder has a 0,37% “chance” of creating a unicorn. Hence, one might wonder why these companies attract so much interest. Put simply, when taken together, they have attracted (pre-IPO) more than 40% of the investments made in the old continent’s FoodTech.

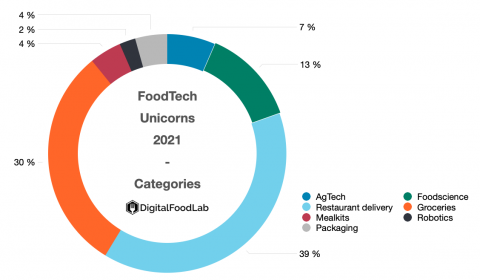

1 – What are unicorns doing?

A large majority (67%) of unicorns are related to delivery, either for restaurant meals or groceries. The latter category is growing faster now with more and more ventures developing new approaches to grocery delivery. Although most unicorns in this area are Chinese, they may be joined by some European counterparts this year.

Alternative proteins and the future of food generate a lot of buzz, but few startups in this field have reached the unicorn milestone. The four well-known leaders of this space, Beyond Meat, Just, Impossible, and Oatly were all founded at least ten years ago. It seems improbable that many new players in the plant-based category will be able to reach this status.

However, we can expect new foodscience startups to surpass the billion dollar valuation in the next couple of years as huge rounds of capital will be needed to build the infrastructure around precision fermentation and cellular agriculture.

Emerging trends are also represented with Nuro (a startup developing autonomous cars for grocery deliveries) and a couple of startups in packaging, which are now part of this mapping.

Compared to last year, we also have three surprises:

- we have removed Luckin Coffee following the fraud scandal surrounding the Chinese coffee company (a potential competitor to Starbucks)

- Gousto, a British meal kit startup, has become a unicorn. This was a surprise as this ecosystem has been considered as mature for years.

- Zume is still here but has switched categories. Initially, the startup developed a pizza robot but now it focuses on compostable packaging (notably for meal delivery).

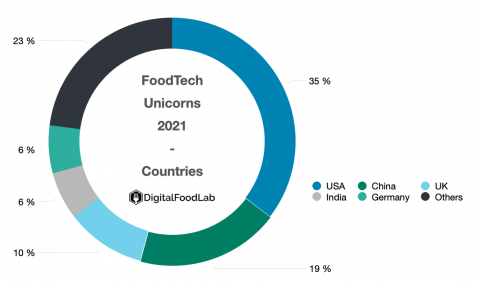

2 – Where are unicorns born?

Focusing on a handful of startups such as unicorns can be a powerful tool to create a quick image of a market. The mapping of the 48 FoodTech startups above also gives us a map of where FoodTech happens with:

- 35% of the FoodTech unicorns in the US, clearly leading the ecosystem (even in terms of investments, its share makes up around 50%)

- 27% in Europe, which is higher than its share in FoodTech investments (around 15%). It shows how money tends to be more concentrated in winners.

- 35% in Asia, notably in China (9 unicorns) and India (3). Growth in terms of investments and the creation of unicorns has been steeper in Asia than anywhere else.

What’s next for unicorns?

As explained above, unicorns are only signals about what the future may look like. When investors are betting such amounts of money on a handful of startups in a specific ecosystem (such as grocery delivery), it is often an indication that something is happening. Indeed, unicorns are one of the many signals we use when we look at the various trends in the FoodTech ecosystem (see our dedicated report here).

From the mapping, we can see that three big trends are missing: urban farming, lab-grown foods (with the exception of Just, which is still primarily a plant-based startup) and insects. Next year’s mapping may contain some startups in each of these areas.

Get in Touch

We work with our clients to identify and act on the best Foodtech opportunities

By email

contact@digitalfoodlab.com

Our office

14 avenue de l’Opéra, 75001 Paris, France