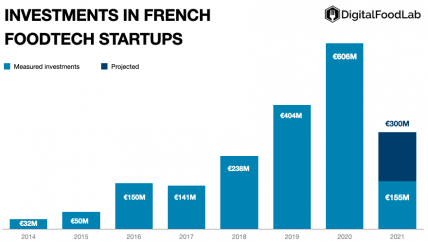

In 2020, French FoodTech startups raised €606M

This is 50% more than in 2019. Growing in such a context was a feat.

However, this growth was not perfect. First, it doesn’t seem to be sustained. For the first half of 2021, French FoodTech startups have only raised €155M, and we project a total amount of 300M for the whole year.

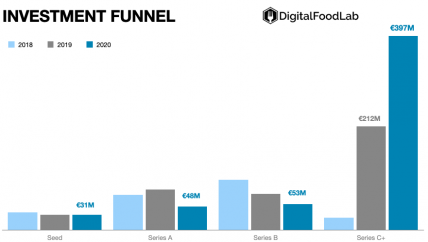

Then, the 2020’s growth has been made by three large deals in relatively mature startups (Ynsect, InnovaFeed, Swile). Combined, these three deals account for 74% of all the money raised in 2020. This means that the amount of money raised in early stages (seed, series A, series B) has actually declined in 2020.

Some differences appear strikingly when comparing the French FoodTech ecosystem to what is happening elsewhere. In terms of investments at least, it seems that France is missing on the “third wave of FoodTechs startups”. Indeed a limited number of investments have been made in cloud kitchens, protein alternatives (cellular agriculture, fermentation and plant-based) or in grocery delivery (dark stores, farm-to-home, etc.).

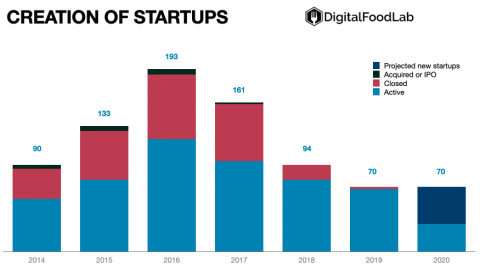

Finally, even in the challenging circumstances of the pandemic (or maybe due to them), French startups are still good targets for acquirers and corporate investors. In 2020 and in the first half of 2021, the number of exits has been significantly higher than in previous years.

In this report

This report studies investments in French FoodTech startups from 2014 to 2021 and contents:

- data on investments and the total amount invested

- a comparison between the 6 major categories of FoodTech

- an analysis of the creation of Foodtech startups in France (with closed and acquired ones)

- M&A in 2020

Get in Touch

We work with our clients to identify and act on the best Foodtech opportunities

By email

contact@digitalfoodlab.com

Our office

14 avenue de L’Opéra, 75001 Paris, France