Startup activity and investments in the Indian FoodTech

Why is DigitalFoodLab interested in Foodtech in India?

« The sleeping elephant has now started to run », this quote of Indian Prime Minister Narendra Modi sums up India’s current economic situation, now the world’s 5th largest economy (ranking just after Germany in terms of GDP). Almost non-existent a few years ago, the Indian innovation ecosystem now has nearly 4300 startups and 77 food startups to look at very carefully. The Indian middle class is growing, the number of smartphone users too and thanks to the increase in online users, this burgeoning market has serious assets to attract business investment and encourage the development of start-ups. From 2011 to 2018, $10.8B have been invested in the Indian Foodtech economy, compared to $688M in France.

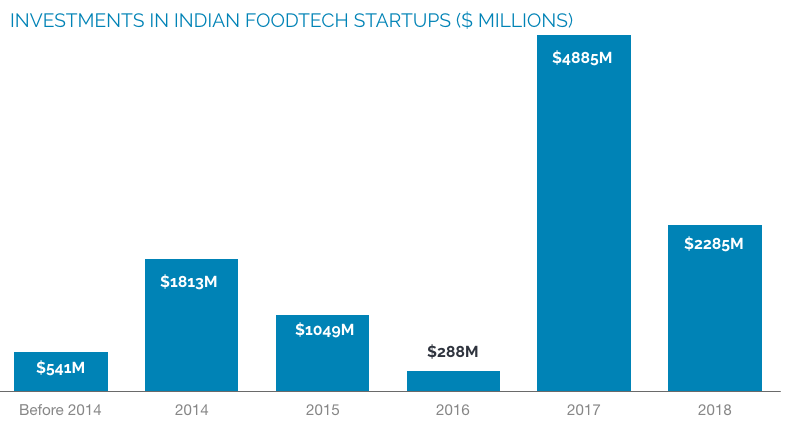

Indian FoodTech startups have seen an increase in investments in 2017 ($4.8B, from $288M in 2016) while the number of deals is constant (24 in 2017, from 24 in 2017). The Indian ecosystem is at its beginning and promises greats surprises. However, these key figures have to be analysed and nuanced. Indeed, India counts four big players, Flipkart, Swiggy, Big Basket and Zomato, which represent 93% of the global investments of the country.

2018 has to be considered with and without the big four. Indeed, there is a decrease in investments with the four principal startups ($2.3B in 2018, from $4.8B in 2017), but an increase in investments without them ($270M in 2018, from $121M in 2017). In this report, you can see what are the new global investors involved in the Indian FoodTech.

The $2.3B invested in Indian FoodTech startups in 2018 could be enough to put India as the second leader in the Asian market behind China with a global share investment of 16%. Bengaluru is becoming the place to be for Indian FoodTech startups.

The main players are Delivery startups: Swiggy, Zomato, Faasos for the Restaurant Delivery; Flipkart, BigBasket and Licious for the marketplaces. Chaayos and Chai Point are great startups for Chai Tea delivery. Milkbasket is a startup specialised in the eggs, bread, butter and juices delivery.

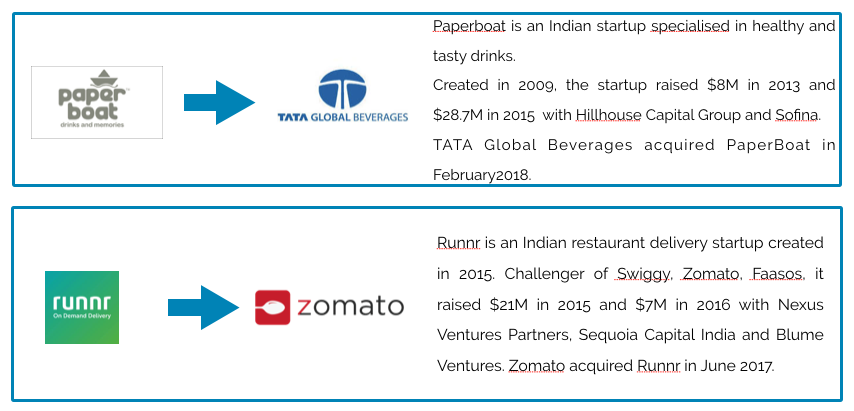

In the FoodScience sector, BIRA 91 is a power brand which sells flavourful beers, Paperboat sells natural drinks that convey a message and ID Fresh Food produces a batter with only natural ingredients.

In the AgTech sector, Ninjacart is the principal agricultural marketplace with Waycool in second position.

Key points of the report:

- Figures and analysis: investments and startups creations

- FoodTech categories breakdown

- top deals in India

- the mapping of the top startups and 7 key startup sheets

- The key innovative Indian cities

- Analyse of the main investors by origin

- The exits in India Foodtech ecosystem

Investments in India

2017 was a prolific year for India thanks to the $3.9B raised by Flipkart (in 3 different deals), the biggest Indian e-commerce platform. In 2018, Swiggy raised $1B from the South African Venture Capital Naspers.

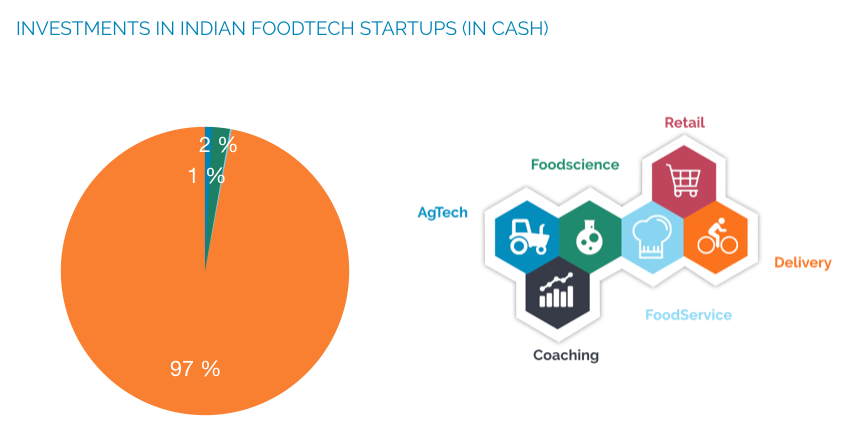

Cash invested from 2011 to 2018 by domain

97% of the Indian investments between 2011 and 2018 have been made in the delivery sector. 74% in the marketplace sector (Flipkart raised $7.1B on the $10.8B) and 30% in the restaurant delivery sector (Swiggy raised $1.5B on the $10.8B)

Bangalore, the Indian silicon valley

Although Bombay or New Delhi is better known to the general public in the West, it is Bangalore that is asserting itself as the Indian capital of technology. With a population of 12.34 million, the capital of Karnataka, in the south-east of the country, is already the fourth largest technology centre in the world.

You will find 7 startup sheets like this one (Flipkart, Swiggy, BigBasket, Bira 91, Ninjacart, ID Fresh Food, Chai Point)

This report explains the 5 big exists that happened in the Indian FoodTech ecosystem.

Get in Touch

We work with our clients to identify and act on the best Foodtech opportunities

By email

contact@digitalfoodlab.com

Our office

14 avenue de l’Opéra, 75001 Paris, France