So, is Germany the heart of Europe’s FoodTech?

We have the tendency to sum up Germany’s FoodTech to Delivery Hero, Hello Fresh and sometimes Marley Spoon. Three startups that have been met with success mostly outside of Germany (in Asia and South America for Delivery Hero, in the US for Hello Fresh and in Australia for Marley Spoon). Hence, it is possible to be quite sceptical about Germany’s ecosystem. However, in this report we were wondering how such world leaders can have been built there and if Germans had a magic equation to build FoodTech Unicorns that could be replicated in other European countries.

Indeed, Delivery Hero and HelloFresh have risen to the status of unicorns and global players. With them, Germany has 2 of the 4 European (the others are UK based Deliveroo and Netherlands’ TakeAway) startups that account for more than 60% of the private investments made since 2014 in European FoodTech startups. This has made Germany an easy number 1 in terms of money invested in FoodTech startups in the last four years.

Reading the German scene behind these two leaders is not as easy as in other countries due to a more scattered ecosystem (even if Berlin is leading). With enough care, we can see the emergence of new startups following (or even being at the origin of) the hottest FoodTech trends such as cloud kitchens (Keatz, eatClever), Urban Farming (InFarm) or product innovation (Yfood).

In our report, you will discover the 225 German FoodTech startups, in which domain they are and how the €2.8B invested between 2014 and 2018 are distributed.

Germany’s FoodTech startups are diverse and some of the startups selected here have a clear unicorn potential, which is really impressive when we compare it to the number of active startups. Indeed with 225 active startups, we have found half as startups in Germany as in the UK or France.

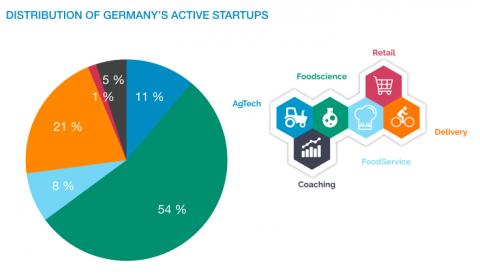

Germany’s FoodTech startups are diverse but there is one domain bigger than others. Indeed, Germany’s FoodTech is not balanced when looking at active startups. We can see a clear (and surprising) majority of FoodScience products that represent 54% of the startups. The domain just behind is the delivery domain which represents 21% of the German FoodTech startups.

Berlin is home of more than half of German Food startups (and more than 90% of the investments are made in Berlin-based startups).

We’ve looked the biggest deals in the last years in the German FoodTech ecosystem and again it is essential to look deeper than the 2 unicorns.

The AgTech startup Infarm raised €88M in 2019 followed by the marketplace Flaschenpost SE which raised €50M and the FoodScience startup Xolution which raised €45M in 2016.

The biggest deal in the last few years remains the €660M deal of Delivery Hero in 2017 from the South African Venture Capital fund Naspers. In the report, you can find a map of the investors in Germany.

We detailed the five FoodTech incubators ans accelerators of Germany.

The proveg incubator is focused on the new meat industry, the FoodTech Campus provides mentors and food space, or the Atltantic Food Labs has invested in the new dark kitchen Keatz.

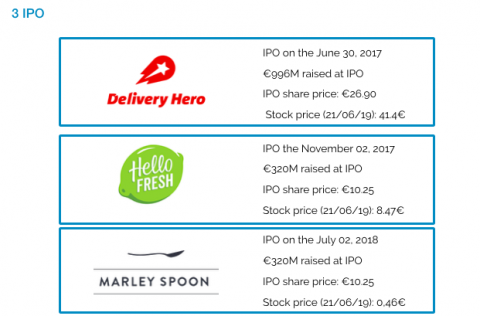

In Germany, three startups have become public : Delivery Hero in June 2017, Hello Fresh in November 2017 and Marley Spoon in July 2018.

In June 2019, the stock price of Marley Spoon is very small compared to the stock price of Delivery Hero (0.46€/41.1€). Indeed, Marley Spoon is present in several countries such as Australia, the USA, Germany or the Netherlands but it is still very complicated for a mealkit startup to be profitable and reassure investors.

You will also find all the German FooTech exits in the report.

Get in Touch

We work with our clients to identify and act on the best Foodtech opportunities

By email

contact@digitalfoodlab.com

Our office

14 avenue de l’Opéra, 75001 Paris, France