FoodTech Delivery in 2019

Food Delivery is one of the hottest topic. It is often regarded by media and pundits as the whole of FoodTech. Indeed, it does not require to be an expert to see that the biggest deals have been made there. But that doesn’t tell us where food delivery is going from there. That’s why DigitalFoodLab deep dived in this ecosystem and realeased this detailed (152-page long) report on the subject. Here are 5 conclusions (much more on the report):

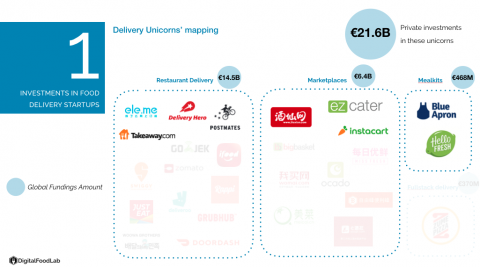

#1 – Delivery is a fast-moving ecosystem with no clear winner

As you can see on the mapping, there is not a single type of delivery startup, but many, some rising and some shrinking (see Discovery Box). In fact, things are getting messier in this ecosystem. While a few years ago, each startup was operating in a specific field (from meal kits to restaurant delivery) with the hope to conquer the world, things have now changed. Consumers have responded with great interest to all of these new offers. But they do not want to stick to one single model, they want a combination of all of them (obviously, each consumer is in need of its own combination). This explains why farm to home (fresh produce marketplace) delivery startups are now putting meal kits on their shelves and why restaurant delivery startups (such as Deliveroo) are now going to the food procurement. In a word, it’s no more war to be your “only source of delivered meals from restaurants” but a war to be your “only source of food”.

#2 – Delivery investments are rising:

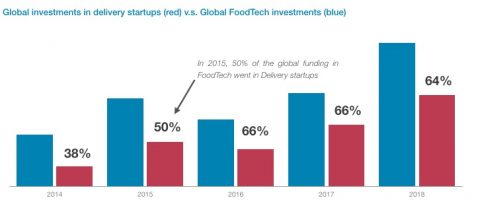

As shown in the graph below, investments in FoodTech delivery startups (red) rising year after year to reach $8.6B in 2018. Counterintuitively, this amount can be split almost evenly between marketplaces (grocery delivery by startups such as Supermercato24, Instacart, GoodEggs, etc.) and restaurant delivery. A small, but rising share of the investments are now dedicated to Cloud Kitchens and in a lesser extent to delivery robots.

#3 – Investments in delivery are rising much faster than other FoodTech categories:

Along with delivery investments in red in the graph below, global FoodTech investments are displayed in blue. In the past 5 years, the share of delivery has risen from 38 to 64% of global FoodTech investments.

#4 – Food Delivery is just starting in big markets (but not in Europe):

Giant marketplaces are developing in the US, China and India (from Instacart to Meicai) but not in Europe where the size of the market of individual European countries is not enough.

#5 – After a lot of investments in some areas (meal kits, restaurant delivery), startups are looking for profitability by expanding in other fields:

Strategies are diversified with many attempts to go vertical (see Blue Apron’s acquisition of a ranch or Deliveroo’s will to supply ingredients to restaurants), horizontal (Swiggy and PostMates now delivery everything) or both ways (HelloFresh launching Go to deliver hot meals in offices while acquiring land to grow its produce).

It’s this fascinating and high-speed ecosystem that we will cover in this report with three goals:

- Take a snapshot of today’s top startups, investments and deals globally in delivery

- Give you clear ideas about the various ways startups are addressing food delivery

- Comparing Europe, Asia and the Americas to look for the hottest spots to look for innovation

Investments in FoodTech Delivery

Geographical breakdown and analysis

Content

- Investments (deals, startups creation, top deals, Delivery unicorns)

- Delivery – category by category

- Subcategories definitions

- Key Graphs

- Sub-Category breakdown

- Delivery by Geography

- The USA

- Europe

- Asia

- South America

- Middle East/Africa

- Exists

- Trends

PRICING

- document: €1800

- document + personalized live briefing*: €3000

- 150 pages

All price are ex-VAT.

The strengths of this report

- DigitalFoodLab is the first FoodTech platform in Europe

- Investors, agribusiness corporates, retailers and entrepreneurs, find all information and analysis you need to understand and act on FoodTech

- A unique analysis of the evolution of the global FoodTech ecosystem

* DigitalFoodLab presents to you and your team the key insights of the report (in English or French)

Get in Touch

We work with our clients to identify and act on the best Foodtech opportunities

By email

contact@digitalfoodlab.com

Our office

14 avenue de l’Opéra, 75001 Paris, France