INSIGHT:

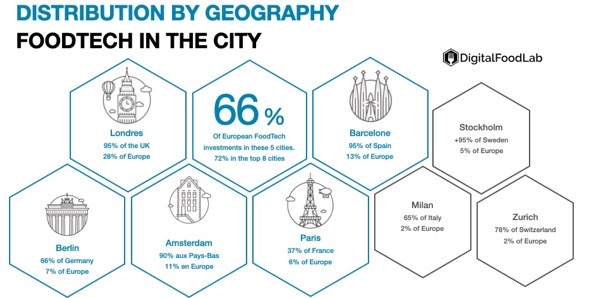

As observed in our report on European FoodTech investments, these are not distributed evenly across the continent. In fact, it is quite the opposite. And even inside leading countries, it is often one city that leads in terms of deals and investments. Eight cities alone account for more than 72% of the investments. Five of them make 66% of the total.

- London has been the hub of European FoodTech until now. We may wonder if things will change with Brexit, it in 2019 it still hosted startups that accounted for more than 95% of the UK FoodTech investments and 28% of Europe’s.

- Berlin, home of unicorns: Delivery Hero, HelloFresh or Marley Spoon. It is now the headquarters of many “second wave” startups such as Choco or InFarm.

- Amsterdam, with its connection to the University of Wageningen, hosts many startups in delivery and AgTech.

- Paris, even without a clear leader hosts most of French Foodtech entrepreneurs (notably when taking into account the larger Paris region).

- Barcelona, home of Glovo and a hub for robotics

- Stockholm, Milan and Zurich, as smaller and more local hubs (in terms of number of startups, deals and amount raised)

WHY IT MATTERS?

Compared to our 2018 analysis of the ecosystem, the leading cities are almost constant. If Paris ranks lower, it is mostly due to the absence of a local unicorn raising huge deals.

We have now a clear division, useful for foreign investors, entrepreneurs and corporates looking for a learning expedition into European FoodTech. Depending on their available time, they can (and already do) plan:

- A quick visit between London, Paris, Amsterdam and Berlin

- The second visit would be to Barcelona, Milan, and Stockholm

- Additional stops in Zurich, Dublin and other cities

We expect this concentration to continue and even to reinforce in the next couple of years. These hugs are still local hubs, each with most or all of FoodTech categories represented. A desirable path would be for them to differentiate and become continental hubs for delivery, alternative proteins, foodservice, etc.

Find out more in our FREE REPORT ON European FOODTECH INVESTMENTS