Reading the news, you could think that plant-based alternatives, notably analogues, were a short-lived fad that is now joining all the crazy ideas that went from hype to bust in a few years. Indeed, recently:

- countries such as France banned startups from using meaty names for their products. Turkey even went further by banning plant-based cheese.

- we have seen the sales slump in the most advanced markets (the US) and still not taking off in others. Stocks of companies such as Beyond Meat and Oatly have been crushed since the start of the year (they lost 50% of their value)

- investments in startups are decreasing

Yet, thinking that plant-based has reached its peak can’t be more wrong. As for the two past newsletters (on how FoodTech will impact our use of land and the future of quick-commerce), I would like to use recently published reports and studies as proof.

1- The moral and environmental argument that will drive more investments toward plant-based

The BCG, in association with Blue Horizon, released an update to its report on alternative proteins. The most striking point is about the comparison of the impact on the CO2eq savings made by investments in different domains that are the main contributors to greenhouse gas emissions. Money put into plant-based proteins has at least three times more impact (in terms of “savings” or carbon not emitted) than in any other area.

This fact alone shows that there is a strong rationale for investment in plant-based and other alternative proteins. This could also be translated at some point into an economic bonus if we put a price on carbon “not emitted” (or the other way around with a tax on meat and dairy products).

2 – Consumers are looking formore plant-based foods, but…

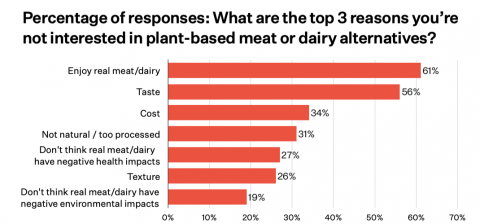

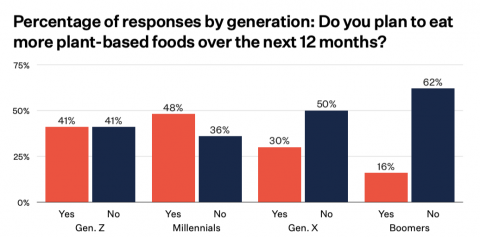

In the last update of its trends report, The New Consumer shows that if “only” a third of Americans are planning to eat more plant-based foods (in younger generations), those who don’t have clearly identified motives, notably because:

- they enjoy meat and dairy products, and plant-based alternatives don’t have the right taste or texture

- cost

- high-processing

- doubts on the health and environmental impacts of meat and dairy alternatives

These four challenges are fittingly what most startups are working on with less processed and better-tasting products (with many different technologies) and better health and environmental claims.

Right now, price (and also availability) may be the most important challenge to solve for consumers to adopt these products. First, price parity (when alternatives will cost the same as animal foods) will help people to try and stick to alternatives. Second, it will drive investments. As shown here, for chicken, a profitable product that was not in high demand can become a best seller if there is an industry push behind.

In a word, data shows the strong potential for growth for alternatives. Growth in this space will be made of jumps and pauses, with each time more demanding consumers.