Today, we’ll look at three graphs showcasing the state of investments in AgTech and FoodTech startups globally. Again, the evolution of quarterly investments in startups isn’t an indicator of what the future of food will look like. But, it is an excellent indicator of the speed at which we are navigating towards it (more money means that innovators have more strength and that legacy players feel the need to change).

The end of mega deals

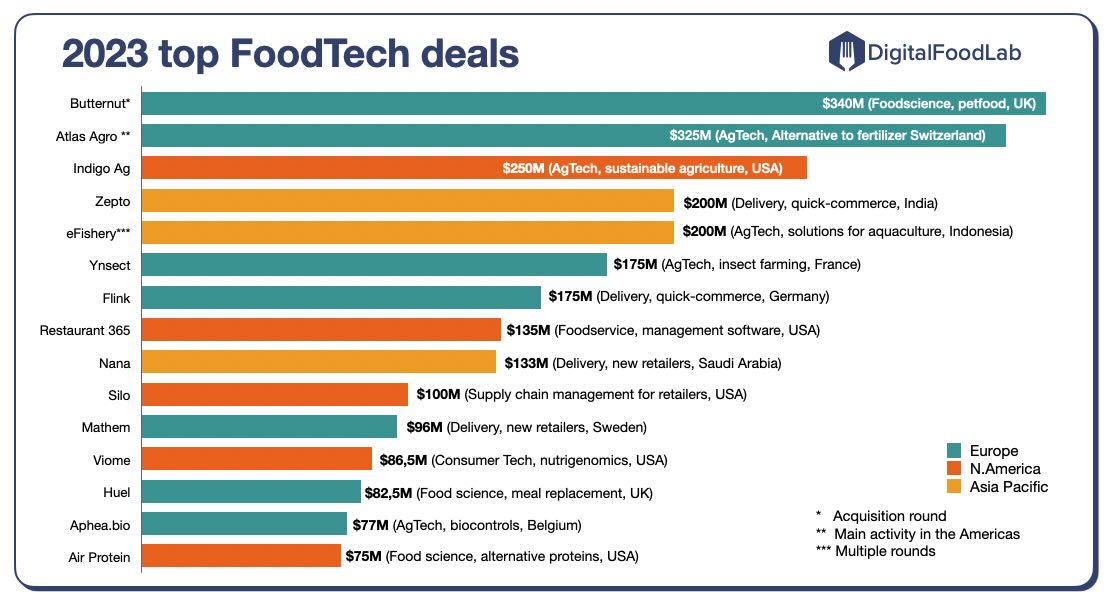

As you can see in the list of the top 15 FoodTech deals of 2023, the number of “mega deals” ($100M or more) is quite limited. And it says something about the ecosystem’s health that the biggest deal of the year was made in a pet food startup.

Beyond that, I see three interesting, often counterintuitive, facts in this top:

- The only alternative protein (for humans, not for animal feed) starting at this top is at the last place with Air Protein (using captured CO2 as a feed for a biomass fermentation process which produces protein). So, even if alternative protein startups make all the noise, they have already fallen out of grace and had a hard time in 2023 to attract significant funding.

- Delivery startups are well represented. If quick-commerce (grocery delivery in less than 15 minutes from small warehouses inside city centres) startups have mostly failed in their effort to scale in developed economies, they are doing quite well in developing countries (notably India and Latin America).

- Bioinputs and biocontrols (bio-based compounds to replace traditional fertilisers and other chemical-based products in agriculture) are the new hype.

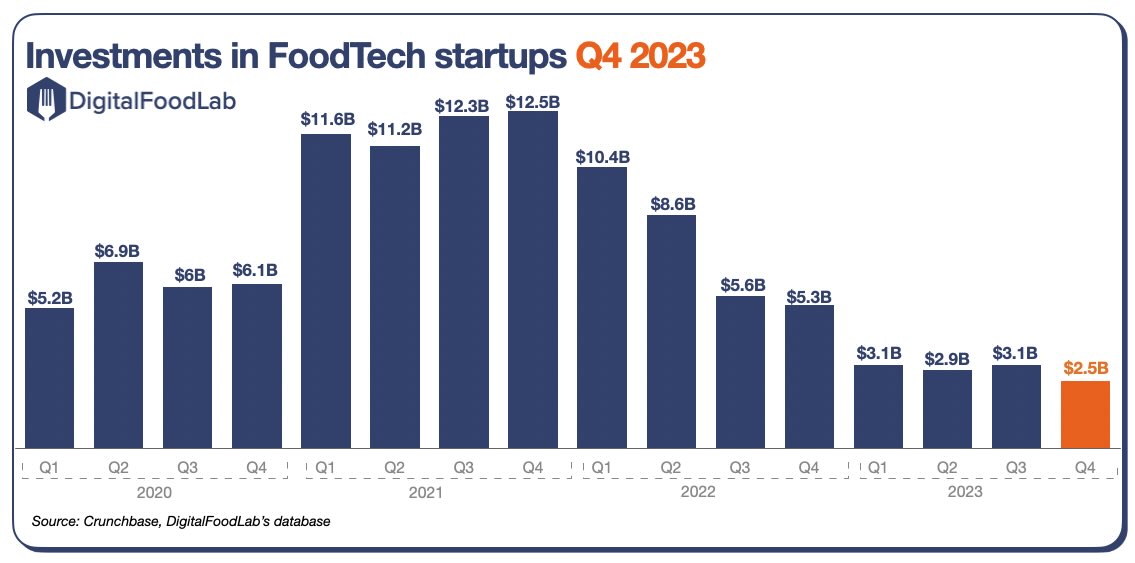

No recovery in sight

There is no way to put it otherwise, but I was disappointed when I looked at the data from the last quarter of 2023. I wasn’t hoping for a refund (as we said recently in our predictions for 2024, we don’t expect it to happen before the second half of this year). However, I thought investments would remain stable.

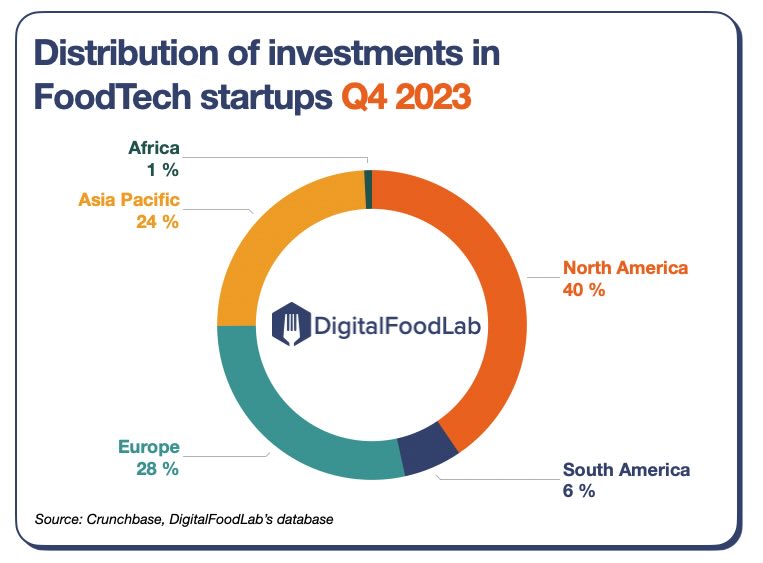

North America, USA & Asia

Finally, the opposite graph shows the new FoodTech landscape regarding investment distribution. If we often focus on what’s happening in Europe, we can’t miss that investments in Asia are also becoming quite significant.

There are now three global FoodTech regions: North America, Western and Northern Europe, and South East Asia (notably India and Indonesia).

So, now, where are we going? At DigitalFoodLab, we expect things to remain stable or even worsen for the next couple of quarters and then bounce back at the end of the year. While this is a problem for entrepreneurs, it also means that planning for the future has become amazingly cheaper than it was two years ago: for investors with some cash in reserve and corporations seeking to differentiate themselves in the future, there are unprecedented opportunities to seize.