Today, I’d like to focus on four graphs that can help us better understand the contradiction in the trends shaping the future of agriculture and food.

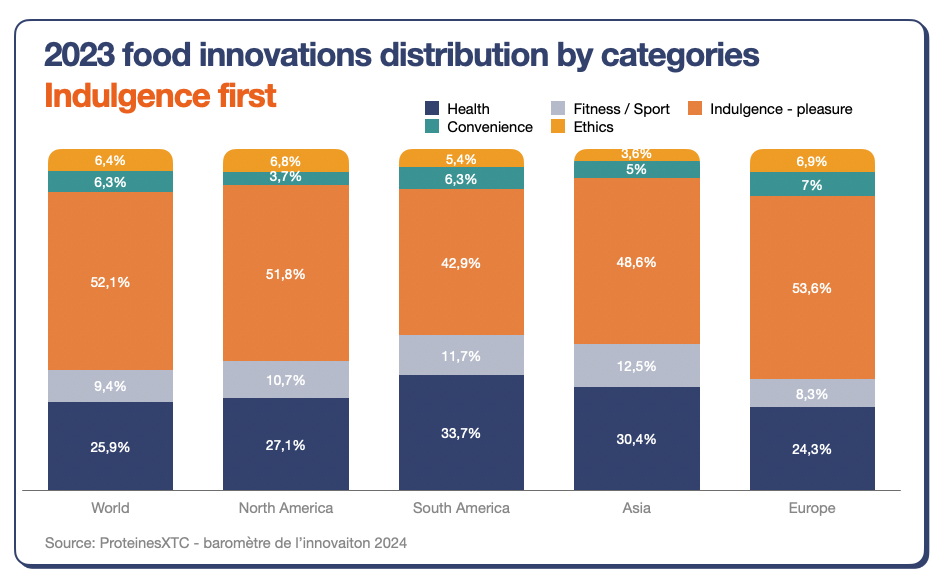

1 – Brands bet on indulgence rather than health for their product innovation

Here, we often talk about innovations related to health (healthy ageing, new functional ingredients, GLP-1), fitness, or ethics (notably environmental concerns). But, if we look at this first graph showing the distribution of “innovations” launched by CPG brands worldwide, we can see that they are first and foremost betting on “pleasure products”.

It even seems that the share of indulgence innovations is raising compared to health-related ones. That’s not really surprising in a context of inflation (as healthy ingredients and reformulation are expensive for the consumer). I know that we are mixing different horizons (here this is mostly about incremental innovations, while we are in this “future of food” newsletter mostly focused on disruptive and long-term innovations). However, we (and I mean mostly entrepreneurs and investors), shouldn’t forget that consumers are not rational beings when they buy food products, pleasure and indulgence is and will remain their first driver for quite a long time. In a word, don’t make virtuous but awfully tasting products!

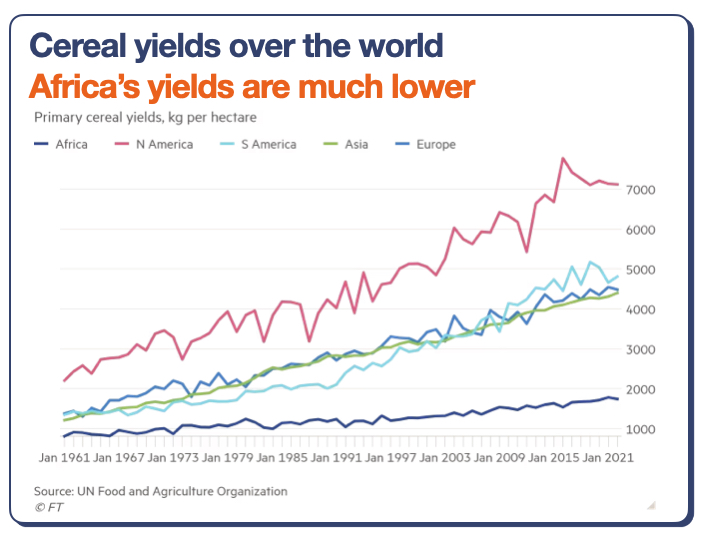

2 – The need for a new green revolution (in Africa)

The FT released a very interesting piece on how Africa could feed the rising world’s population. It shows that the continent has not yet known the green revolution that has been observed elsewhere in the world in the second half of the 20th century: a combination of a massive increase use of fertilizers (primarily nitrogen-based), mechanization and crop selection led to an explosion of the yields across multiple continents.

As you can see, it never took off in Africa. Now, the question, is “can Africa leapfrog this revolution and directly move to the next generation?” The continent’s needs are gigantic and increasing, while the past recipes are also known to have their (climate) limits. Recently, we mapped some of the solutions to decarbonize agriculture, it would be great that more of the startups and innovations were be targeted to Africa.

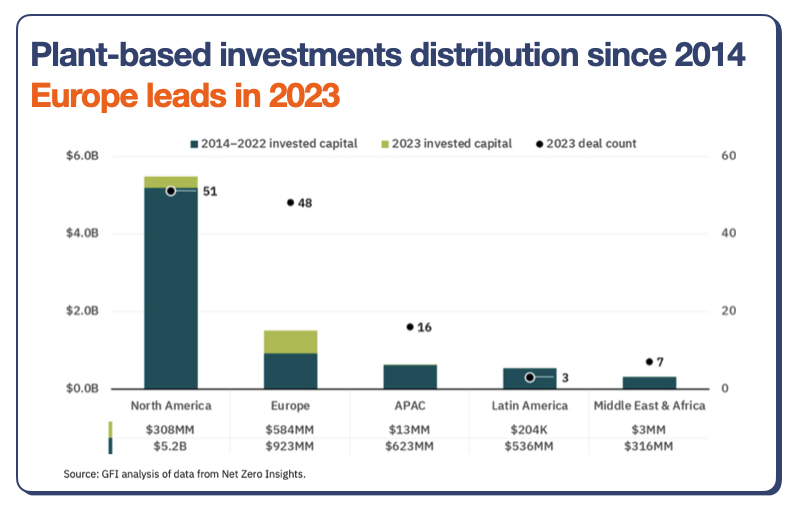

3 – Plant-based investments decrease everywhere except Europe

The Good Food Institute released its annual reports on alternative proteins (always a good read). Investments are declining in almost all technologies, and almost everywhere. Only one continent is doing well: Europe.

However, using the above graph comparison with the past 9 years of funding, shows that there is still a gap to be bridged for the old continent in terms of investments.

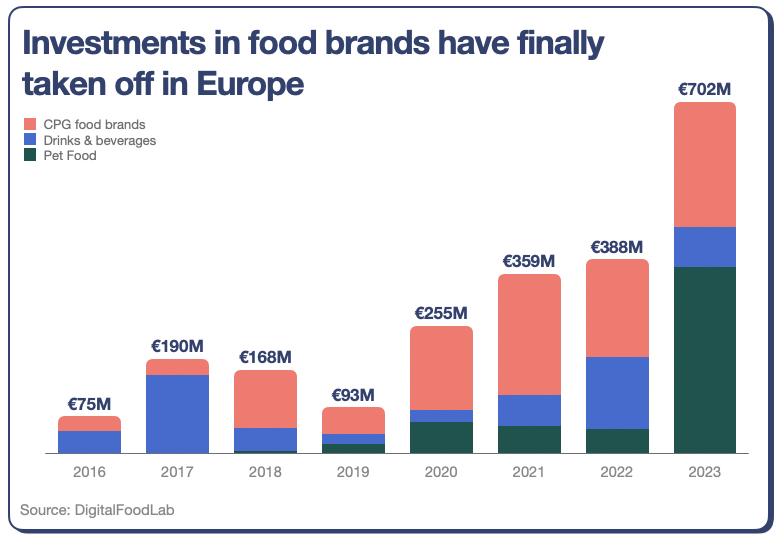

4 – Brands in Europe are taking off

I love food brands. And for years, I have been quite miserable when looking at the number of startups launching food and beverage brands in Europe. Some were doing good things, but rarely had the opportunity to scale as investors were worried about the cost of expanding in new markets. And also, quite related to the first graph showcased here, too many startups were doing virtuous products (on the environmental side notably) that were quite distant from what “real-world consumers” would ever buy.

It seems that things have changed: the number of food, beverage, and pet food startups has increased, as is the number of deals and the investments they received.