A month ago, we released the FoodTech Top deals for the first half of the year, both at a Global and a European level. Now, I can share with you the level of investments. I’d love to say that they are bouncing back, but that’s quite far from the reality we observed in the data. However, everything is not dark. Hidden in the data, I have found things that make me reasonably optimistic and indicate that we are not far from bouncing back.

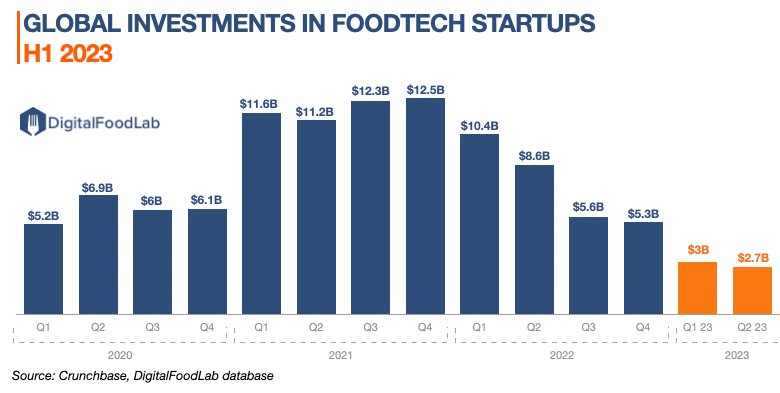

Global FoodTech investments are stabilising… at low levels

Investments in Q2 2023 have again decreased, but “only” by 10%. They reached a shallow level compared to previous years.

In many ways, this data confirms what we saw with the top deals, or sooner this year with our report on FoodTech unicorns: the absence of mega deals (multiple hundred million) has a notable impact on the ecosystem’s overall health. To put it more bluntly: the companies that should be raising these rounds are either shutting down or downsizing and hoping for better days (the example of Perfect Day, a leading alternative protein startup, once rumoured to be planning an IPO, now shutting a part of its activities hastily, is quite striking).

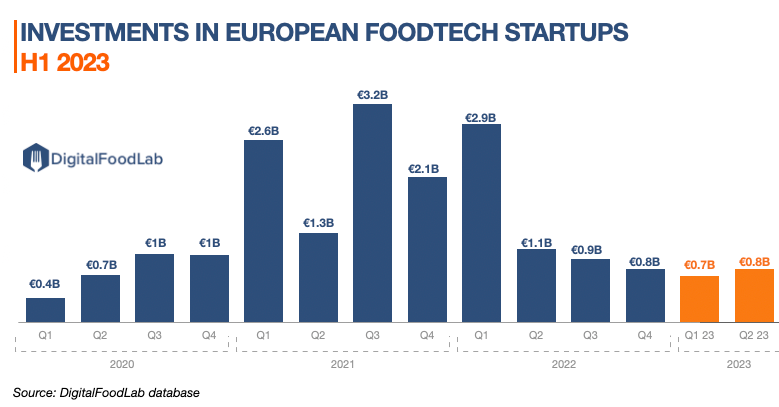

Already bouncing back in Europe?

Interestingly, we have a couple of reasons to be optimistic when we look at the investments in European FoodTech startups:

First, if investments also decreased in Europe, they floored at a comparatively higher level than global investments. This is primarily due to some large deals still happening in Europe. This resilience is provided by public backers (such as France’s BPI) and also by the fact that valuations were already much lower on the old continent than in the US.

If this pattern holds in the year’s second half, European startups could account for 30% of global FoodTech investments, almost twice as much as its usual 10 to 15% “share”.

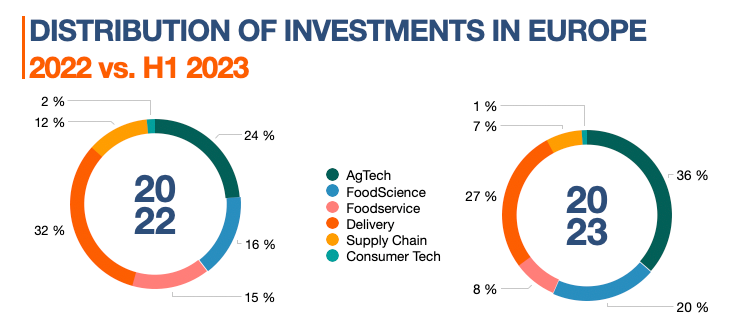

If we look at where investments are going in terms of categories, again, we see that the upstream and midstream parts of the value chains are relative winners (only relative, as in absolute value, the amount invested there also decreases). Still, this also coincides with a greater appetite for climate and impact-driven investments, which find more value in agriculture and new food products than in delivery.

Deal size is still decreasing

We also observed a steep decrease in the median size of the deals observed. Even from Q1 to Q2, the median deal decreased by 15% in size. This confirms something we have already discussed in this newsletter: deals are still happening, notably in early-stage startups. That’s maybe the best news of all!

What are your expectations of Global FoodTech investments in 2024 and 2025? Can be a growth of investments, especially because of the investments in the European startups?