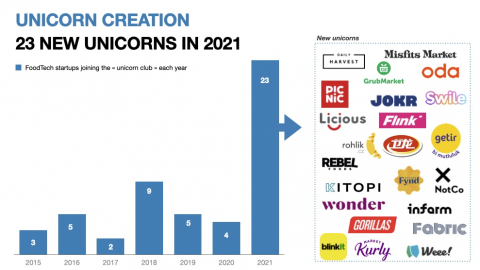

Last week, we released our report on FoodTech unicorns (23 pages, freely accessible here). One of the key findings of this report was the growing number of unicorns (23 new unicorns in 2021 alone, 55 in total). This is an unprecedented growth in the number of new unicorns. Indeed, in the previous years, the average number of new $1B+ startups was about 5.

Beyond the reasons that have created these new not-so-rare unicorns, I was puzzled by their future when writing this report. Indeed, it is admitted that being funded by investors (VCs notably) is only transitory, as is the “startup” phase, more or less like childhood. I see at least three paths for these startups:

1 – The most common route: the acquisition. It’s the most common exit for startups. In the “past”, notably, when I created my first FoodTech startup in 2010, the main goal was to raise money to grow enough to be “attractive” to an established corporation. But for companies with valuations of €1B to €40B (GoPuff), this seems more than complicated. As you can see below, in 2021, out of 3 acquisitions, 2 were made by other deep-pocketed startups.

2 – Public markets, which are becoming the main exit road for FoodTech startups with IPOs (and SPACs). Until recently, very few food companies went all the way to the IPO. Now, as you can see, 8 unicorns went public last year, joined by 5 other startups whose valuation went higher than $1B with the IPO.

However, consider the three examples above (others are similar or worse). If these startups have received a very high valuation at the IPO, now their stock is trading much lower. This could mean that new IPOs could become more complicated. It seems that the public markets may be fed up with startups with an unclear path to profitability.

3 – Remaining private: more and more money is pouring into innovation, startups, and beyond into private equity. We could see some companies, such as Brewdog did, choose to remain privately held and then avoid the scrutiny of the public markets.

In any case, this quick analysis on a very small subset of the FoodTech ecosystem reveals that something may be problematic with the current state of startup valuations. For now, money is here to sustain them, but for how long?

Do you want to understand how startups (unicorns and smaller fish) can help you understand the future of your business? DigitalFoodLab is here to help you navigate the waves of the food revolution and to build your strategy to leverage long-term opportunities. We can provide you with information (workshops, FoodTech watch), insight, and strategy consulting.