As we have seen in our recently released report on the state of the European FoodTech ecosystem, investments are decreasing, and we have not reached the bottom. We still expect the 6 to 12 months to come to be complicated. This decrease implies that some startups do not find the funding they need and so are going bust.

However, investments are a very crude measure of the declining appetite of investors for FoodTech. Indeed, as observed in the report, we observe a shift from formerly hype categories (such as vertical farming or quick-commerce) to new hype (such as new beverages, virtual restaurants, B2B marketplaces). Unlike what we often read, this movement is not necessarily a “healthy and rational return to a normal situation”. These new hype categories are not intrinsically better, revenue-driven or addressing real-world issues than former ones.

Valuations (the amount of money that one should pay to acquire a company) would be a better way to evaluate the state of the ecosystem. Here, the information is hard to access and often confidential. However, we have some hints from recent deals or rumours such as:

- Flink is considering being acquired by Getir or raising fresh cash at a valuation of $1B, a downturn from its $2B+ valuation in late 2021.

- Swiggy, one of India’s two giant food delivery startups, is now valued [at $11.5B, half of its previous $22B valuation.

- Ynsect recently raised €160M but with a lower, unspecified valuation.

With these examples and others, valuations could have been slashed by up to 50%. Does it reflect the “real value” of these startups in today’s market?

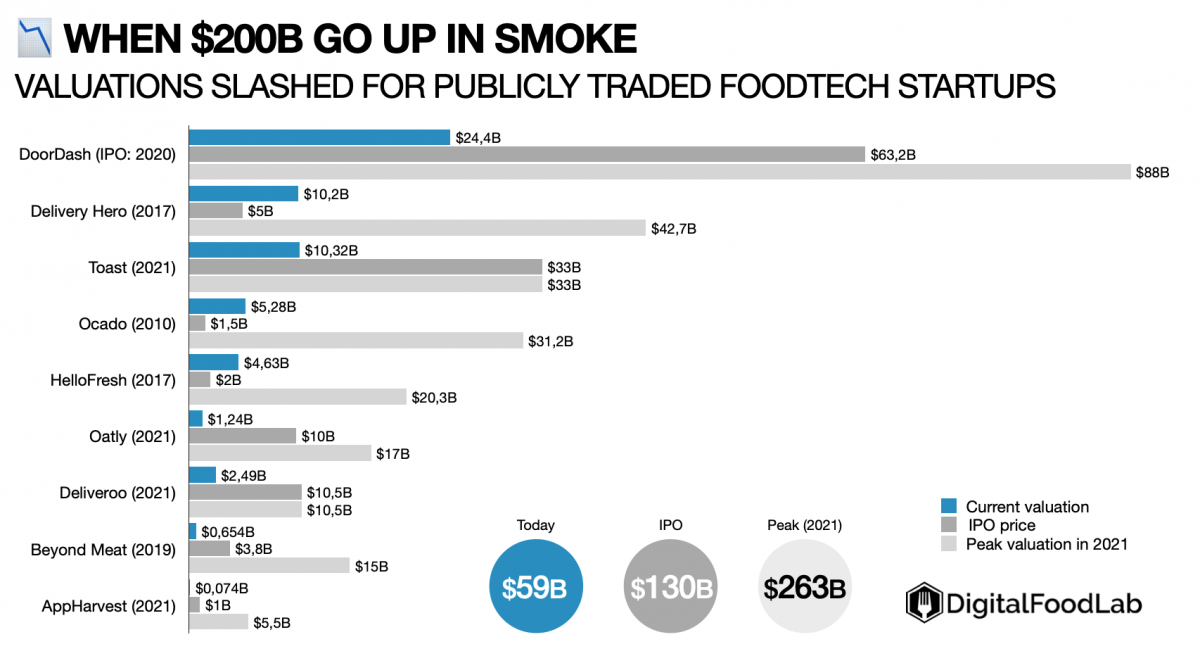

Beyond scattered information about deals in private startups, we have one easy way to look at things: publicly traded companies. Thousands of investors exchange stocks of these companies daily. Let’s look at 9 “iconic” former FoodTech startups which went through an IPO in the past decade:

- Their collective IPO valuation was $130B

- At peak valuation in 2021, they were worth $263B

- Today, this is down to $59B

So, in less than two years, these nine companies destroyed $200B of value. To put things in perspective, $200B is approximately Greece’s GDP.

It means that these startups lost 80% of their value, much more than private startups. Some are more affected than others, with an AppHarvest losing 99% of its value (a good example of defiance against vertical farming).

From this, we can learn three things:

- we can say that in the short term, many private startups are still overvalued and that we are not yet at the end of the “cleaning”. Private markets are indeed slower to adjust to new realities than public markets.

- for most of these nine startups, we are not at the bottom in terms of valuation. Talking about a rebound may be optimistic, but results and the general mood is more positive than it was six months ago. If a rebound is confirmed here, it will surely affect the whole FoodTech ecosystem in 2024.

- this is only a market cycle, not the end of the world: look at the IPO value of the three oldest startups. They are now worth more than they were in 2017.

In a word, looking a public markets maybe a better indicator of the current state of mind of investors and of the general market that just looking at deals. We’ll regularly update this “index” to see how things are moving and how well it reflects the state of the ecosystem.