While investments are down in the FoodTech and ClimateTech sectors, one area at the intersection is doing well. Indeed, investments in startups seeking to decarbonise the food supply chain have increased significantly in 2022 and 2023. Today, let’s look at the reasons for such a success and the startups attracting all this money.

1 – Why are food decarbonisation startups doing so well?

First, there is the obvious elephant in the fridge: climate change. Indeed, after a slight decrease in 2020, meat production has rekindled its steady growth (about 3% per year).

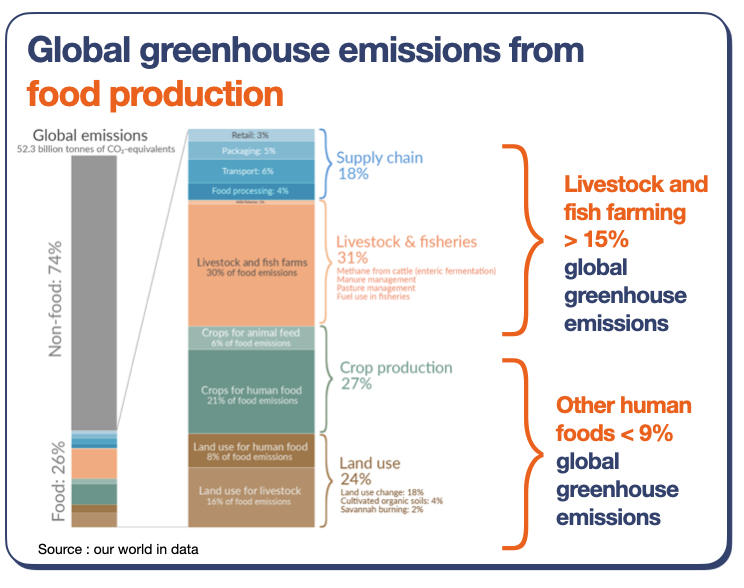

And, as you can see on the opposite graph, if food is responsible for more than a quarter of all emissions, livestock and fish farming are the main contributors.

Another reason is the energy crisis, which increased the cost of agricultural inputs (and hence created an incentive to find solutions).

Finally, and most importantly, leading agrifood companies have all recently announced their “pledges” to reduce their impact, aiming to achieve net-zero emissions by 2050. Better, they often plan to achieve a reduction of 30% to 50% (Nestlé or Mars) by 2030. These companies have a “cow problem”: the main challenge is reducing the impact of beef and dairy products as the world’s demand increases. Global leaders even announced a $200M+ alliance at COP28 to find solutions to lower methane emissions (quite noticeable in an industry usually dominated by intense competition).

In a word, there is now very strong pressure on these companies to find solutions to reduce emissions throughout their supply chain. It creates a huge incentive to invest in innovation, hoping to find the solutions that will enable those pledges to become a reality. Let’s look at how a food company can decarbonise its food supply chain.

2 – What are the solutions?

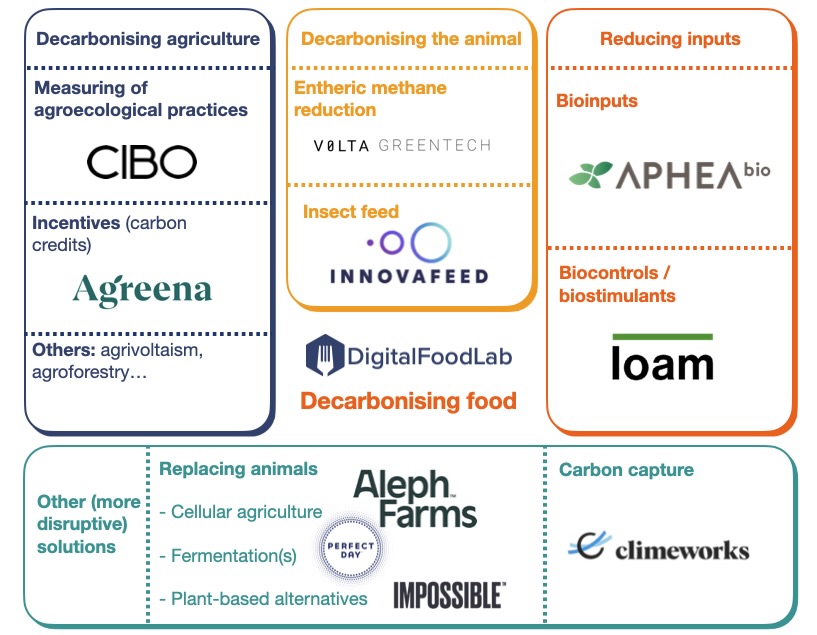

As we said, the challenge is in the complexity of the topic and the absence of a single and easy solution. While some praise the agricultural model of our forefathers, this can’t be a solution to feed the whole world. Below is DigitalFoodLab’s “easy map” to help you navigate it.

While it doesn’t include all the sub-categories and subtleties of detailed mapping, it shows that there are four broad areas that a leading agrifood company needs to address when considering how to decarbonise its supply chain:

🧑🌾 Decarbonising agriculture through regenerative practices:

- While we know “what should be done”, the challenge is to find solutions to measure and finance these practices. That’s why a growing number of startups are here to help farmers identify the most impactful practices to put in place, measure their impact, and then emit credit carbons to sell them to food companies. This is notably the case of Agreena, a Danish startup (and one of our Europe’s Top 50 list).

- In our opinion, one of the most critical aspects is “measurement”: it’s easy to emit credit carbons, but if these companies want to build trust, they need to be able to prove that carbon was stored in the soil.

🐮 Decarbonising the animal:

- This is the most “hype” category, with an impressive increase in startups (such as Volta GreenTech primarily working around feed additives, which are supposed to reduce the amounts of methane a cow emits by up to 80%. While this is still an early-stage space, it benefits from significant funding and public support (rare enough to be underlined). However, while it may appear as a silver bullet, it comes with its own challenges.

- Changing what animals eat, notably by replacing it with insects, could be another partial solution and could contribute to reducing deforestation linked to animal farming.

🌾 Reducing chemical inputs: this space is the most mature, with various solutions, some of which are already in the industrialisation phase (such as Aphea.bio). While cost remains an issue, regulations on some pesticides (notably in Europe) pave the way for these startups.

🚀 Other solutions can be found by rethinking completely the system:

- The most obvious example is to “replace” animal foods with other sources of proteins, either plants, fermentation, or more advanced technologies (such as cellular agriculture).

- As we have seen above, the solutions to reduce the impact of farming are powerful but won’t achieve full decarbonisation by themselves. One additional venue could be carbon capture and storage.

3 – What’s next, and what should you do?

Food companies have to answer (at least) three tricky questions:

- Timing: how to balance the efforts between short-term (solutions that can be deployed now, from regenerative agriculture to a switch to a more plant-based portfolio) and long-term ones?

- Balance between all these innovations: all seem essential, but which should be prioritised, and how should they be approached? (from collaboration to investment to acquisition).

- Collaboration vs. competition: is this a space for cooperation with competitors (as shown with the methane example mentioned above) or a new space of competition? Indeed, is achieving its emission reduction a marketing differentiator for companies or something they should address together to face the regulator?

As you can imagine, there is not a one-size-fits-all answer. DigitalFoodLab can help you explore this space and set up a strategy for decarbonisation; contact us!