Each year, we map the evolution of the different FoodTech trends shaping the future of food. We are starting to work on 2023’s edition that we’ll release this month. Today, we’ll focus on sustainable proteins, the second megatrend and maybe the most commented one.

Alternative proteins attract thousands of entrepreneurs and billions of euros in investments while being a source of intense debate. Acting on what we eat may be the most obvious way to reduce our impact on climate change. Indeed, animal proteins as a whole are directly linked to up to 18% of global greenhouse emissions.

We can identify at least five different technological approaches to alternative proteins. Companies using them have a few things in common, as they are:

- Mostly trying to replicate animal products that we know and love, from meat to dairy. This is seen as the best way to help consumers « transition » from meat to alternatives and become real flexitarians.

- Marketing themselves as healthier, better for the planet and animal-friendly alternatives beyond simple « substitutes ».

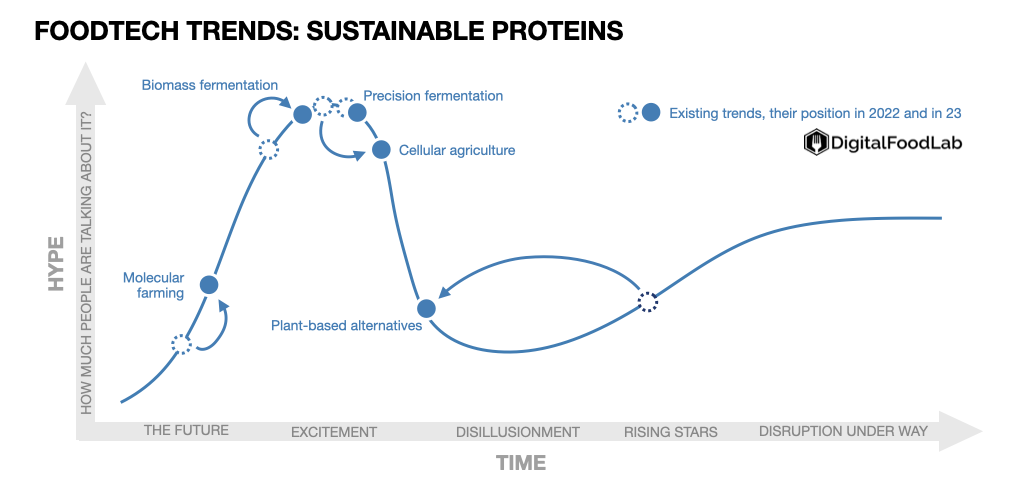

We map trends on an innovation curve which can show how a typical innovation evolved from discovery to a pick of excitement (everybody talks about it, somehow irrationally) to a phase of disillusion (where many trends vanish) to productivity (people using the new technology or service).

🐜 At least five technologies compete to replace meat and dairy products as we know them. Compared to 2022, we removed insects for humans as they just vanished after reaching the « disillusionment » stage.

🍔 For the first time in five years, we moved a trend backwards. We already explained our reasoning here, but we were (as many) wrong on how advanced plant-based products were and how ready consumers were for them. Plant-based alternatives are getting in the disillusion stage, with many people predicting its end. While we collectively get ahead of ourselves, solutions to plant-based products’ many challenges are now almost market ready.

🧫 Cellular agriculture (cultivating cells to recreate animal products), precision fermentation (producing animal proteins through the fermentation of genetically modified bacteria) and biomass fermentation (using fermentation on a newly identified extraordinary microorganism to produce proteins) are at “the top of the hype”. Companies are starting to open their pilot facilities and request regulatory approval. We predict that there will be doubts about their ability to produce at scale and fund their transition from lab experiments to industrialisation.

🌵 Molecular farming (using genetically modified plants to produce animal proteins) is still a very young and unproven technology. However, it is receiving more and more attention, notably with the recent IPO of Moolec.

All of these technologies share the same two challenges:

- Scale (producing larger quantities as cheaply as possible)

- Acceptance (both by regulators and by consumers)

The year will prove decisive on these two fronts, as most leaders are waiting for their pilot facilities to be completed by the end of 2023 and are also expecting regulatory approvals in Singapore, the USA or Israel.

Then, one question will remain: how to finance and structure the alternative protein industry? Indeed, tens of billions will be needed in the next couple of decades if we want alternative proteins to have an impact on the global climate trajectory (only to build facilities and the bioreactors inside them). One answer could be distributed production (bioreactors in the cloud as an analogy to the cloud computing industry).