Two weeks ago, we released our report on the state of the European FoodTech ecosystem (which you can download for free here!). Investments grew exponentially in size (x3 the amounts of 2020) and number all over the continent. Our feeling is that this growth is an indication that the European FoodTech is getting proportionally stronger, which would be really good from our point of view (after all, one of DigitalFoodLab’s missions is to accelerate the European FoodTech ecosystem).

But, it could also well be that investments just grew everywhere, specifically in the FoodTech ecosystem or that Europe’s “tech” become more attractive. To see if our intuition is correct, let’s look at the facts!

1 – investments in European FoodTech startups grew more than elsewhere

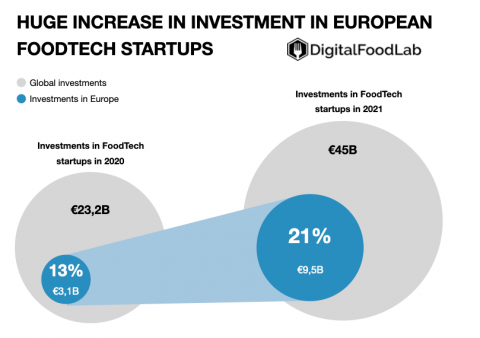

Investments in FoodTech increased significantly in 2021 (x2 compared to 2020 according to AgFunders’s data).

However, in the meantime, investments in Europe grew even more, and hence the share of the ecosystem is now above 20%, a level it never reached (it was always between 8 and 15%).

Beyond FoodTech, investments grew by more than 150% to $116B in Europe’s tech ecosystem in 2021. So FoodTech rose from around 8% in 2020 to more than 10% of the overall venture investments in 2021.

If we look at the data itself, we see that foreign investors and leading food companies have not missed this trend. We observed the growing presence of non-European funds in the biggest investments (with well-known names such as SoftBank’s Vision Fund and Tiger) and acquisitions (by large US startups (DoorDash, GoPuff) and corporations (Kraft Heinz)). The fact that DigitalFoodLab’s report was sponsored by Chinese startups such as Pinduoduo is also a sign of the global appetite for agriculture and food innovations coming out of Europe.

In a word, 2021 has been a transformative year for Europe’s FoodTech. It has become stronger locally, and more importantly, it is now a leading hub.

2 – It’s not all about cash; Europe’s FoodTech now leads in many of the most important trends

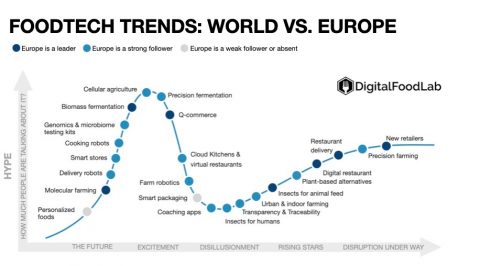

The graph below represents the main domains of interest for FoodTech startups worldwide and their advancement along the « hype curve », from ‘idea’ to ‘being available and used by all. You can look at our report on Global FoodTech Trends for more details.

One difference is striking compared to previous years: the quasi-absence of trends where the European FoodTech ecosystem is a laggard. Though Europe may not yet be a leader in most areas, it has at least a handful of interesting startups.

For the ecosystem, it’s an excellent sign that we can quickly identify many exciting startups across the « four types of trends »:

- Short-term

- Hype (when a lot of people talk about it but with a long road still ahead)

- Long-term / niche

- Disregarded/facing doubts

It should be noted that in tech in general, investments have significantly decreased in the first quarter. We’ll see how this will play out for FoodTech specifically, but it seems true that the levels will be considerably lower at first sight.

However, we have never felt so optimistic about the state of FoodTech and even more about Europe’s FoodTech. And again, it’s not all about money (which is important to compare the evolution and see if entrepreneurs will have the means to accomplish their vision). The trends above and the billions invested into them have the potential to help us build a better food system for our planet and our health. Europe may be well-placed to lead this revolution with the right mix of talent (from entrepreneurs and corporations), luck, money, and public policy (the sore point).