We have been curious about Israel’s ecosystem for years. If one country is above its weight in FoodTech, it clearly is Isreal. It is hard to discuss some topics, such as alternative proteins, ingredients, crops or precision agriculture, without mentioning Israeli startups. In this newsletter, we will try to answer one simple question: is it just hype or is there something real behind it?

First, let’s have a look at investments in Israel. As you can see below, investments have risen sharply in the past five years. As for other ecosystems, 2021 was a “boo” year with a huge increase (more than doubling) in investments to reach $905M. Beyond this impressive amount, we can learn two things when looking at this ecosystem:

- it is highly specialized: 68% of 2021’s investments went toward alternative protein startups. This makes the country the second destination globally for investments in the sector. This is quite impressive when compared to the country’s size.

- a quick look at the top deals made in 2022 shows how Israeli startups can attract huge investments and foreign investors.

Both these factors explain how well the ecosystem is coping with the current valuation and funding crash in tech startups. We project a slight decrease which is softened by large deals in alternative proteins which have been made at the start of this year. Just in January 2022, Redefine Meat (alternatives to meat made through 3D printing), Remilk (precision fermentation for dairy products) and Tipa (compostable packaging) raised respectively $135M, $120M, and $70M.

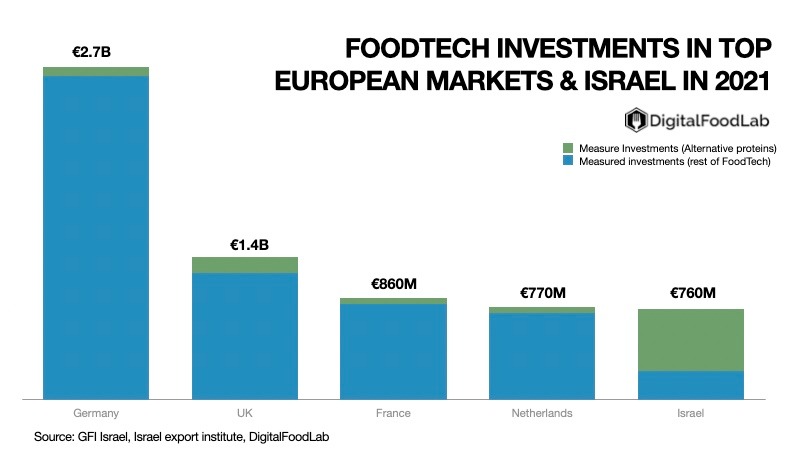

Then, we can wonder how this compares to other markets, notably in Europe. As you can see in the following graph, Israel’s FoodTech ecosystem would be the 5th in Europe. Again, when compared to the size of the other countries on the graph, that’s quite something. These amounts may be explained by a focus on the American market and, in return, by the presence of US investors.

Apart from investments, when we looked at the data, we were struck by the ability of this ecosystem to surf the trends shaping the future of food, notably around sustainability, health and resilience. It is also impressive to see how many ventures have been created by researchers or where the IP is coming from universities. That’s something other ecosystems should definitely emulate.

In a word, even if it has grown significantly over the past years, we feel confident that Isreal’s FoodTech ecosystem still has much potential to grow. We would definitely recommend you to look at B2B ingredients, alternative proteins and packaging solutions coming from Israel.