We just released DigitalFoodLab’s yearly report on the state of the European FoodTech ecosystem (download it for free here). As a whole, investments declined, but there are strong categories and geographical disparities. Today, we’ll look in depth at the latter.

Before that, let me invite you to a couple of online events where we’ll discuss the future of food globally and in Europe:

- On the 18th of April, we’ll present findings on the state of the Swedish (with a focus on Stockholm) FoodTech ecosystem. Register here

- On the 20th of April, we’ll host a webinar to reveal DigitalFoodLab’s European FoodTech Top 50 with our mapping of the startups with the strongest potential to invent the future of food.

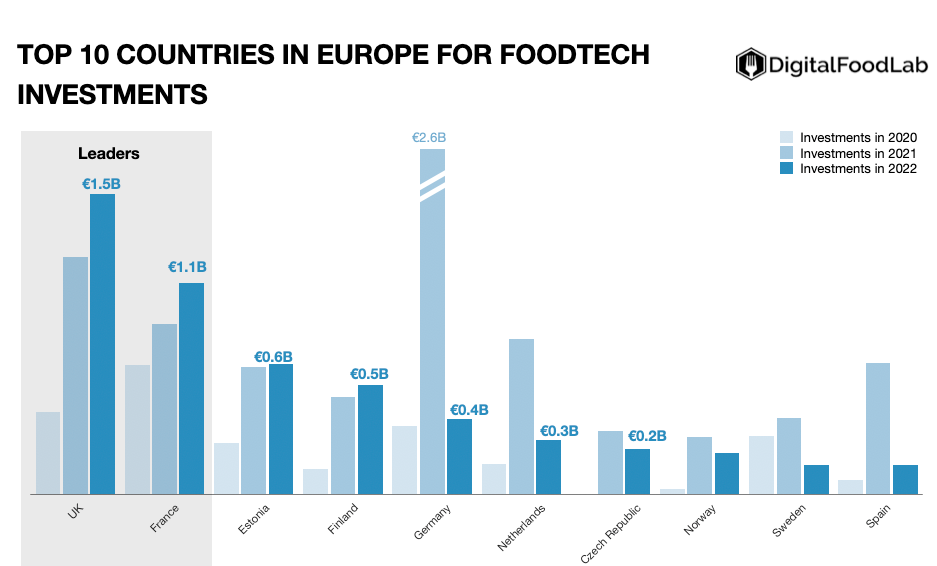

As you can see below, investments are unequally spread over European countries and with very different trajectories. Let’s look at the best locations to launch a startup and raise money for a FoodTech startup in Europe in 2023.

Looking at the raw investment data is not enough. Indeed, only using the graph above, it looks like it’s a great idea to launch in the Czech Republic. But actually, there is almost only one startup there (Rohlik, an online grocery retailer).

Similarly, Norway is not necessarily better than Sweden, even if the amount raised in both countries is similar. Again, for Norway, all the money went to a single company (Oda, also a new online grocery retailer), while Sweden has a large and diversified set of startups. So, even if money is a relevant indicator, it does not make a country or a city a hub.

Actually, we can sort the different countries into four groups. Let’s see what we can learn from each of them:

Leaders: these are the real FoodTech hubs where all the different categories are represented (here are the definitions). Here we have a weird 2+1 situation:

- France and the UK with growing FoodTech sets of startups, investors and a lot of public and private support. In both cases, it is more a story about one capital city rather than a country. The concentration of investors, incubators and expertise in a single city greatly helps the constitution of an ecosystem. Over time, this creates a positive feedback loop: when a new international accelerator looks to open an office in Europe, it will probably do it there.

- The Nordics, which, if taken together, are a hub but still lack a “meeting point”. Even if investors are mostly transnational and are betting on startups in all the regions, entrepreneurs are not.

One-startup-countries: these are ecosystems where more than 80% of the investments are concentrated in a single startup.

This means that without it, they wouldn’t be on the radar. As we’ve said above, this is the case of countries such as Estonia, Norway or the Czech Republic. However, launching a new venture here can be a good idea if some early employees have accumulated enough capital and talent to become entrepreneurs or business angels.

Local hubs: this is the most diverse group of countries with proportionally strong and growing ecosystems, such as the Netherlands or Finland, and others in a more complicated situation, such as in Germany. What’s common to all of these local hubs is their ability to be really strong in one category, either AgTech, new food brands, alternative proteins… These can be great places to launch a venture matching this local strength.

Distant followers: areas where the number of startups and the funding is proportionally small to the size of the economy. This is notably the case in Poland. It may not be the best location to launch a new venture.

In a word, there is no one-size-fits-all solution to the question of where an entrepreneur or investor should look. But I think it’s a very good thing. We are finally converging in Europe toward a stable situation with a limited number of hubs where most of the activity will happen. This will notably help foreign investors to look at what’s happening in Europe (it’s easier to look at what’s being made in two cities than to have to analyse a dozen different regulatory and funding contexts).

⇒ This is only a quick summary of our (free) 77-page long report. Download it here, and if you find it useful, share the link!