As I was looking for some data on the investments and new FoodTech hubs in Europe, one big question became obvious: have investors vanished from Germany?

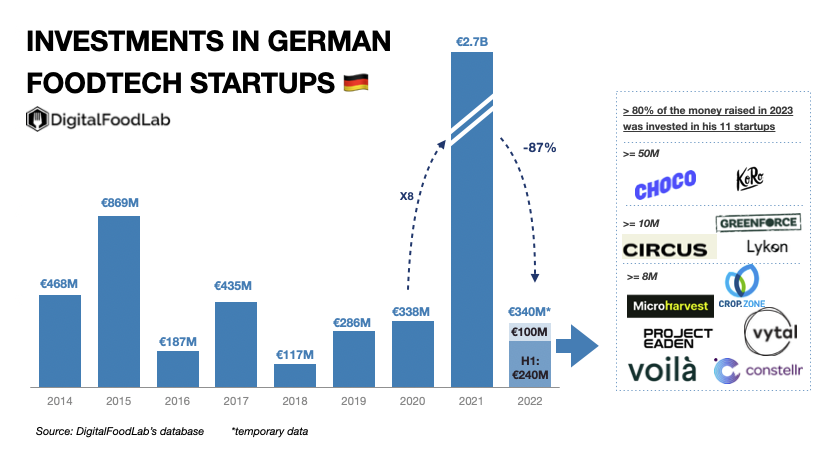

Indeed, if you look at the temporary data on the investments in German FoodTech startups in 2022 (graph below), you can see that they decreased by almost 90% in one year. This is even worse in the year’s second half, where only €100M was invested, compared to €240M in the first half. How can we explain such a situation for an ecosystem often seen as a European leader with investors flocking to Berlin?

Significant decrease in the number of noticeable deals

We mapped the deals that made 80% of the investments made in German FoodTech startups in 2022. Except for two “mega deals” (bigger than €50M) in Choco (a chat app to connect restaurant owners and their suppliers) and Koro (a vegan food brand), all the other deals were relatively small.

Shift in priorities while being “dependent” on a few startups

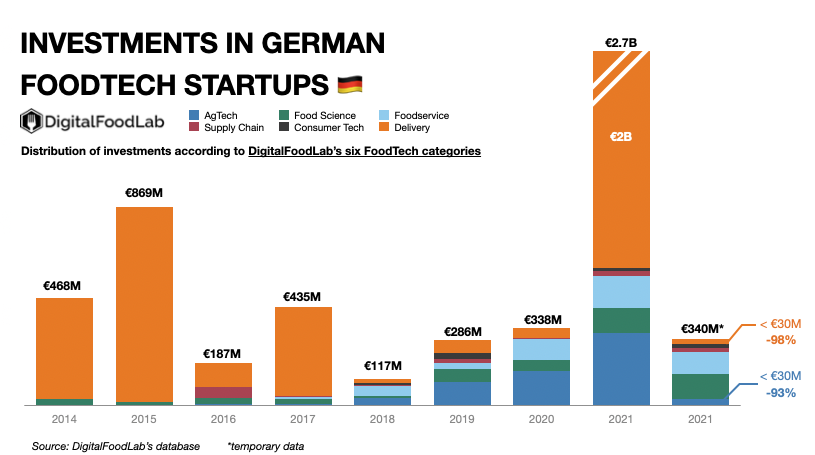

In 2021, more than 95% of the funding went to three startups: Gorillas (acquired by Getir), Flink and Infarm (closing half of its locations). This shows how things are different. Both grocery delivery and indoor farming are much less attractive than they were only a few months ago.

Investments in delivery startups decreased by more than 98%, as those in AgTech startups decreased by 93%. As for other countries highly dependent on one or a couple of startups (as for Spain with Glovo or Estonia with Bolt), the landing can be hard.

The German ecosystem is still full of very promising startups (many of them in the list of 9 companies above). However, Germany’s FoodTech has a limited number of entrepreneurs working on some of the key trends of today’s FoodTech. And after years of having its delivery startups leading the way (with HelloFresh and Delivery Hero, now two publicly listed companies), the new delivery trends are coming from other countries rather than Germany.