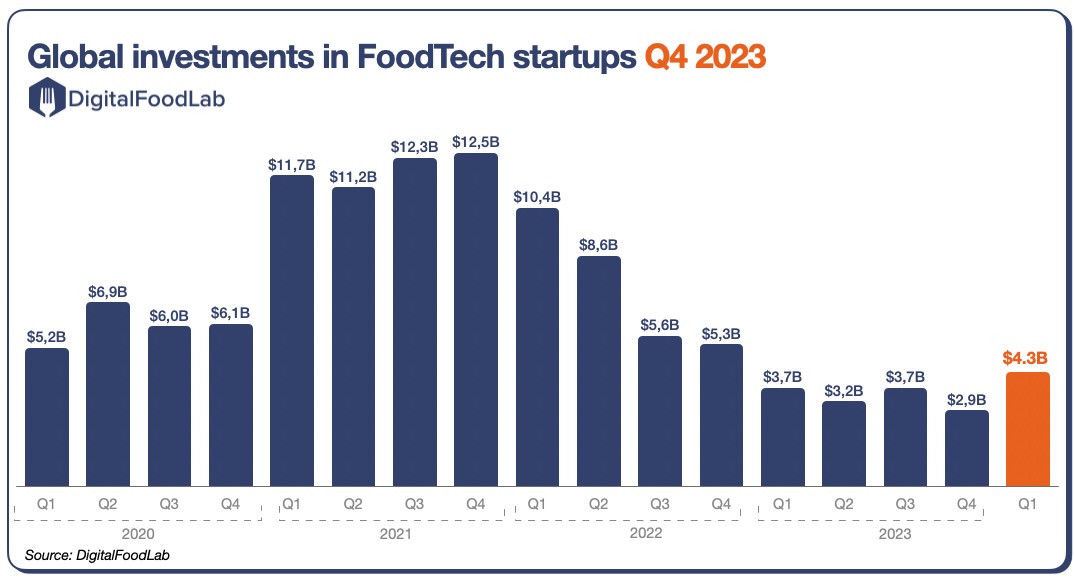

Today, we’ll look at three graphs showcasing the state of investments in AgTech and FoodTech startups globally. The evolution of quarterly investments in startups is an excellent indicator of how trends evolve.

As you can see on the first graph above, we have observed a quite significant 16% increase in investments in Q1 2024 compared to last year.

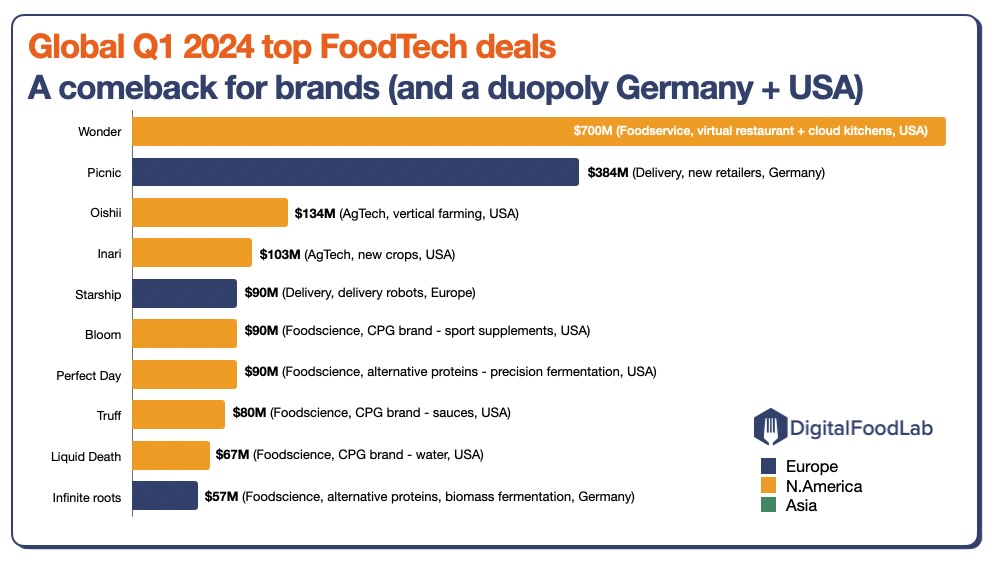

Looking a bit more in depth into it, notably at top deals, we can see that this has been driven by a couple of mega deals: more than $1B went to these two startups, Picnic and Wonder.

Also, when we look at this top 10, we can be seen as signs that a rebound is in sight:

- Brands, notably CPG food and beverage brands (and not plant-based innovations) are very well represented. If these brands receive such large fundings, it’s probably that they are able to attract new customers (profitably), so that the worse of the recession’s effects on consumer behaviour toward innovative products is ending.

- investments in some discredited categories such as grocery delivery, virtual restaurants, and even vertical farming with one startup in each category: are these players the “final winners”? At least, here at DigitalFoodLab, we wouldn’t bet against Picnic and Oishii, that we consider as among the most interesting startups globally.

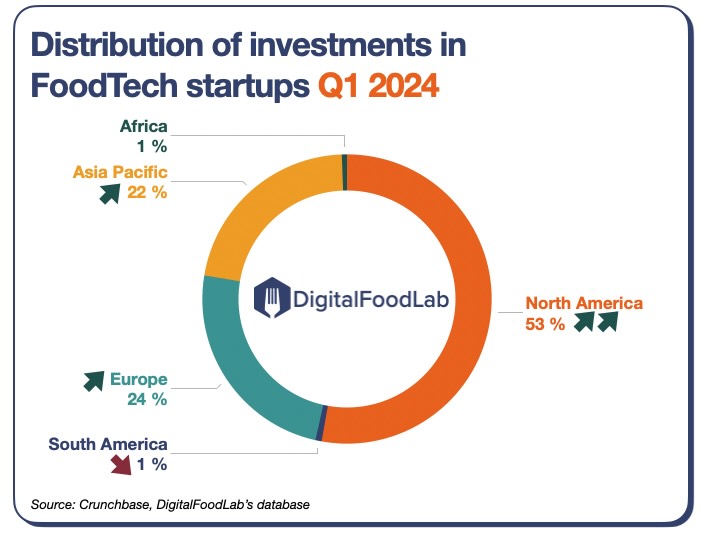

A boom coming from the US

As you can see in this last chart, the increase in funding is mostly coming from the US (notably compared to our previous state of the investments).

Investments are also increasing in Europe (notably Germany) and Asia, but less so than in the US.

As we predicted a year ago, if there is rebound, it will come first from the US.

So, now, where are we going? At DigitalFoodLab, we expect things to remain stable, with small such evolutions in Q2. After that, depending on the macro-economic context (we expect investments to increase again when interest rates are lowered) which should happen by the end of the year.

Then, in terms of trends, the main drivers remain the same with health, sustainability (with implications in agriculture and new food products, notably proteins) and brands being the three “engine of growth” of the ecosystem.